The future for gas and LNG is highly uncertain, particularly as new supply continues to come online in a market that may struggle to absorb it.

Economic growth is becoming an increasingly important proxy for greater gas usage globally. Industrial sector demand–including gas as a feedstock for petrochemicals and fertilizers–has increased in significance as a growth driver relative to gas consumption for power generation. And there is now a huge question mark around economic growth moving forward due to the coronavirus pandemic.

At the same time, the prospect for sustained lower oil prices has the potential to impact the global gas industry directly through oil-based pricing and indirectly through associated gas production.

Consultancy Geopolitics Central (GPC) has two medium-term scenarios for the global gas market—‘flash pandemic’ (FP) and ‘double whammy’ (DW)—each with very different outlooks for the global economy and the oil price. Gas consumption, production and international trade in both scenarios can be compared and contrasted to those in Gas 2019, the pre-pandemic outlook for natural gas through 2024 from the International Energy Agency (IEA).

Economic growth

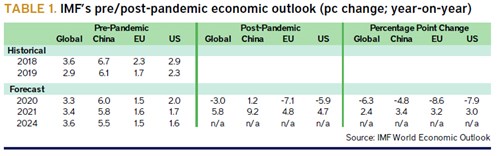

Global economic growth–and thus natural gas consumption—even in the short to medium-term is hugely uncertain. The IMF admitted as much in its half-yearly World Economic Outlook (WEO) mid-April. But what we can say is that for this year, at best, it will be very bad indeed.

The IMF took a chainsaw to its 2020 global economic outlook, and while it projects a V-shaped recovery in 2021, it admits the ultimate outcome may be much worse. It chose to not even release a medium-term forecast in its latest report (see Table 1).

The fund assumes economic disruptions caused by the lockdowns are concentrated mainly in the second quarter of 2020 for most countries, with China the most prominent exception, where the impact was most intense in the first quarter. It now forecasts the global economy to contract by 3pc in 2020, compared to 3.3pc predicted growth in its January update.

Economic growth is forecasted to then rebound sharply by a meaty 5.8pc in 2021, 2.4 percentage points more than the previous forecast and the fastest rate in the post-Second World War era. However, “much worse growth outcomes are possible and maybe even likely,” warns the IMF’s economic counsellor Gita Gopinath.

Many major economies were already running low on fiscal and monetary ammunition before the Covid-19 crisis, having driven economic growth higher through a combination of deficit spending and easy money since the 2008-09 global financial crisis. And yet these coun-tries have further opened fiscal, monetary and liquidity taps to try to keep their economies afloat, avoid massive personal and business bankruptcies, and deter another full-scale financial crisis.

“The effects of the health crisis on economic activity and financial markets could turn out to be stronger and longer lasting, testing the limits of central banks to backstop the financial system and further raising the fiscal burden of the shock,” the IMF cautions.

It models three alternative short-term economic scenarios: a 2020 lockdown lasting c.50pc longer than its base forecast; a second, but milder, outbreak of Covid-19 in 2021: and a more protracted pandemic, combining both the first two scenarios. In the IMF’s third, worst-case scenario, the global economy contracts by c.6 pc this year and over 1pc the next.

Oil supply

The fate of the oil price is another major uncertainty, both on a macro-economic level and specifically for the energy industry. Obviously, it is inextricably linked to a significant degree to the economic outlook, as the severity of recession will determine how much demand comes back at any point in the cycle.

But it must also be borne in mind that the breakdown in Opec+ happened while Saudi Arabia and Russia were still massively underestimating the demand-side impact of the coronavirus. It was, in effect, their ‘business-as-usual’ response.

So, it seems reasonable to assume that the April deal represents a cobbled-together response to unprecedented events, forcing unwilling allies together in a marriage of convenience. This could mean that, as demand and prices start to recover, the tensions and motivations that provoked the move to unconstrained supply will re-emerge.

As such, understanding could be a long game. His agreement to April’s Opec+ production cuts—despite other major oil producers such as the US failing to agree to concrete cuts under the auspices of the G-20—may therefore not signal surrender and the end of any price war, but rather merely a tactical retreat.

The latter would mean that the upside to any oil price recovery on a demand-side rebound could be severely limited. In effect, as demand comes back, Russia could continue to dampen prices by leaking more supply onto the market, either by formally rejecting its Opec+ commitments or by flouting compliance ever more brazenly.

The wild card could, unlikely as it may seem, be the fall of Putin himself. Russian watchers feel his position—due to the precipitous drop in hydrocarbons revenues and his administration’s ponderous response to the health crisis posed by Covid-19—is less secure than ever before.

With the fate of former Yukos boss Mikhail Khodorkovsky always on their mind, Russian oil oligarchs tend to be reluctant to show dissent. To see Russian producer Lukoil’s vice-president and co-owner Leonid Fedun comparing Putin’s U-turn to the national humiliation of the country’s ignominious withdrawal from the First World War, via the 1918 Treaty of Brest-Litovsk might, will at the very least, raise an eyebrow.

The IEA view on the health of the global gas LNG market in its Gas 2019 report can be inferred from its regional price assumptions. For Europe, the agency forecast the benchmark Dutch TTF price to average $6.60/mn Btu in 2019 and 2020, slipping slightly to $6.40/mn Btu in 2021, before gradually rising to a $7.20/mn Btu average in 2024.

The IEA therefore seemed to conclude that the global gas market’s struggle to absorb supply would be a relatively short-lived and shallow affair. The reality has swiftly overtaken the forecast, partly due to the Covid-19 pandemic. The TTF is currently sub-$3/mn Btu, and the price slump is likely to last substantially longer in both GPC’s two scenarios.

The FP projection is as good as it gets for the global gas and LNG market in a post-pandemic world. The scenario as-sumes the IMF’s V-shaped economic collapse and rebound in 2020 and 2021, and global economic growth to average the fund’s pre-pandemic 3.6pc pa for the remainder of the outlook period (see Table 1). Russia’s willingness to fight an oil price war is also assumed to have ended with the recent Opec+ agreement.

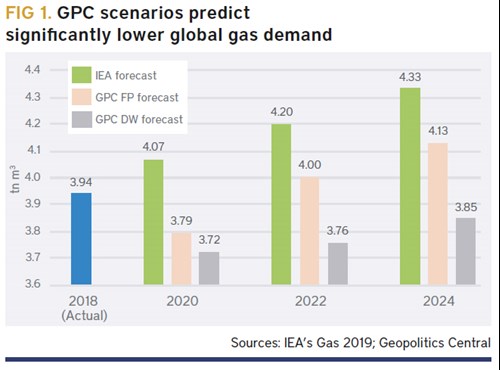

Despite relatively optimistic assumptions, global gas consumption falls far below 2018 levels in 2020, before rebounding back above in 2022 and growing strongly for the remainder of the period (see Figure 1). Under FP, global gas demand increases by 190bn m³/yr to over 4.1tn m³/yr between 2018 and 2024, roughly half as much as the IEA’s pre-pandemic outlook–which were based on IMF economic forecasts available at the time.

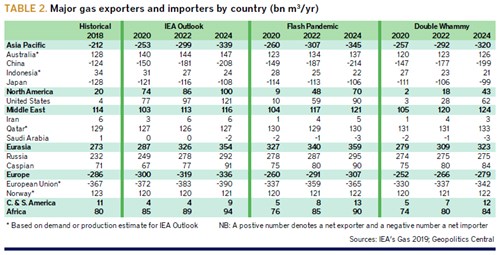

As one would expect, lower-cost gas exporters perform relatively better under FP given the soft market in the outlook period’s first half, especially those selling gas on a longer-term contract basis and by pipe—with Qatar’s fully-amortised production the notable exception among major LNG exporters (see Table 2). Qatar, Norway, Russia and Caspian region producers are relative winners in FP compared to the IEA Outlook through 2024, whereas new kids on the LNG block, including Australia and especially the US, are major relative losers.

Under FP, the global LNG and gas supply headache should ease by late 2022 or early 2023, with the TTF gradually rebounding, but only to an average of $6/mn BtU in 2024.

As the name suggests, global gas markets are hit by both a significantly weaker economy and resumed oil price hostilities under DW. The world economy is assumed to contract this year and next, as in the IMF’s worst-case scenario for short-term growth, and expand by only 2.7 pc pa over 2022-24. And Putin returns to targeting US shale once the worst of the pandemic induced oil demand destruction comes to an end later this year.

Global gas consumption remains below 2018 levels all the way through to 2024 under DW—although increasing slightly between 2020 and 2022, and significantly more between 2022 and 2024 (see Figure 1). Global demand declines by 94bn m³/yr from 2018 levels to 3.85tn m³/yr in 2024, with a nadir of just over 3.7tn m³/yr in 2020.

Under DW, Putin succeeds in keeping crude prices in a $25-30/bl target range through 2023—causing sustained damage to the US shale industry, including associated gas production—before allowing crude prices to creep higher in 2024 (see Table 2). The gas and LNG export winners and losers, relatively speaking, are the same as under FP, but with the US getting hit even harder and Russia paying the price for its oil war in terms of gas consumption, production and exports.

US gas production in 2024 is basically flat to 2018 at just under 860bn m³/yr—having dipped below 800bn m³/yr in 2020, compared to a 157bn m³/yr increase under the IEA outlook. US gas exports, of which the vast majority are LNG, are 62bn m³/yr, well above the 4bn m³ seen in 2018 as US LNG began to grow, but only around half those forecast in the IEA outlook and two-thirds of those under FP.

Even with a combined 80bn m³/yr less US and Australian LNG on the water in 2024 under DW compared to the IEA central case, demand weakness still trumps reduced LNG supply. The TTF averages just $4.25/mn Btu in 2024 in this scenario.

Comments