On the very day that Russian President Vladimir Putin launched his full-scale invasion of Ukraine—24 February 2022—energy industry leaders from around the world were at a conference in London, warning of a history of complacency around security of energy supply. “If energy flows are interrupted, we are in uncharted territory in terms of how the energy market will respond,” said one CEO.

A year and a half on, as the LNG industry converged on the Canadian city of Vancouver for the LNG 2023 conference in July, the global impacts of a major interruption of natural gas flows from Russia to Europe were all too clear—not least in statistics published at the event by the International Gas Union (IGU) in its latest LNG report.

The focus on how this has affected markets in Asia-Pacific—and what the implications are for future demand growth in the region, not just in the short term but also post-2030—will be even sharper at the Gastech conference in September, which this year takes place in Singapore, a growing regional LNG hub.

Price sensitivity sorely tested

As Russia weaponised its pipeline exports to Europe during 2022, and Europe then scrambled to replace as much of the lost gas as possible with LNG, there was a fundamental reconfiguration of LNG trade dynamics, as cargoes were drawn away from Asia-Pacific. The price sensitivity of LNG demand in Asia-Pacific was sorely tested, not just in South Asian markets such as India, Pakistan and Bangladesh but also in more established markets such as China, where demand collapsed by a fifth, after years of robust growth.

“Securing energy supply came at a high cost to European consumers, who had to pay a high price premium to receive priority new volumes in record short periods,” said IGU President Li Yalan, who is also chairman of Beijing Gas Group. “Consumers in other parts of the world, especially Asia, could not afford the high spot market prices, and had to switch to dirtier fuels and shed demand.”

A tightening of the global gas market that began in late 2021, as Russia began to curtail pipeline gas exports to Europe amid a post-Covid demand surge, accelerated with the invasion of Ukraine, sending natural gas and LNG prices skywards. According to the IGU report, the Platts JKM benchmark hit a record high of $84.76/m Btu on 7 March 2022 while the Platts TTF assessment reached its all-time high of $93.81/m Btu on 26 August 2022.

While LNG played a crucial role in keeping lights on around the world, the gas crisis came at a high cost, not just to consumers and suppliers but also to the environment as widespread switching to coal and oil, especially in price-sensitive Asian markets, pushed up greenhouse gas (GHG) emissions.

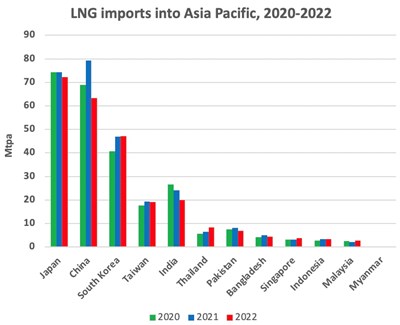

Data recently published by International Group of Liquefied Natural Gas Importers (GIIGNL), the association of LNG importers, shows that Indian imports in 2022 were down by 4.1m t year-on-year, Pakistan’s by 1.3m t and Bangladesh’s by 700,000 t.

LNG demand in China collapsed by 16m t to 63.3m t, as zero-Covid restrictions also impacted gas demand. That decline was the major factor in LNG imports into Asia-Pacific falling by 8% year-on-year, or 20.6m t. It remained by far the leading importing region, but its share of global trade plummeted from 73% in 2021 to 65% in 2022.

Crisis ‘not yet over’

“LNG saved the day and provided energy security,” said Li. But she cautions that, while prices have eased considerably in 2023, “the level of risk and uncertainty remains high, the market is still out of balance and the crisis is not yet over”.

Two major concerns hang over the market as winter 2023/24 approaches in the northern hemisphere: possible further loss of Russian pipeline gas and the harsh reality that little new LNG production capacity is expected over coming months.

Uncertainty is heightened by worries over how harsh winter may be; mild weather in Europe and Asia helped to ameliorate shortages during winter 2022/23. There is also the ever-present risk of unexpected outages at liquefaction plants, for instance the explosion in June 2022 that put the 15m t/yr Freeport LNG project out of action for eight months.

Three-year wait for new supply wave

“The loss of Russian pipeline gas is a loss to the global system and has not been redirected elsewhere in the way that oil has been,” said Michael Stoppard, global gas strategy lead and special advisor at information provider S&P Global Commodity Insights, during the final plenary session of LNG 2023.

“LNG has shown extreme flexibility, but it has not been able to add incremental molecules overnight to the global system. Those spot prices that we produce at S&P Platts are telling us about the pain being felt by buyers all over the world because of gas stranded in western Siberia.”

“The platform for a new wave of supply is being set up but that will be a post-2026 phenomenon. So, there is going to be a lot of soul-searching about how we get through the next three years, as we reshuffle existing trade between different regions of the world.”

That loss to global supply could grow in coming months if Russia imposes further supply cuts. In a report on gas supply security published ahead of July’s LNG Producer Consumer Conference in Tokyo, the IEA cautions that:

“A cold winter, together with a full halt in Russia piped gas supplies to Europe early in the heating season, could easily renew market tensions. Fierce competition for gas supplies could also emerge if Northeast Asia experiences colder-than-usual weather and economic growth is stronger than expected in China.”

There is broad consensus that Chinese demand growth remains a major uncertainty for the global LNG market during 2023.

“We expect natural gas demand to come back but we are not seeing China roaring back to life,” said Laura Page, principal LNG analyst at Kpler, a provider of commodity analysis. She points out that any increase in gas demand would be met partly by rising domestic production and growing imports from Russia as the Power of Siberia pipeline ramps up to full capacity.

“There is some room for growth in LNG import demand this winter,” said Page, “but it will be limited and will depend on the economic situation and temperatures. We could see up to around 3m t of additional LNG demand, supported by long-term contracts and an increase in regasification capacity.”

LNG appetite returns in South Asia

Months of decline in spot LNG prices to around the $10/m Btu level appears to have renewed appetite for LNG in the economies of South Asia, with Pakistan recently announcing a deal with Azerbaijan’s SOCAR for one cargo a month and confirmation that a third import terminal in Bangladesh is moving forward.

Both countries increased their LNG imports in the first four months of 2023, though Pakistan struggled to attract bids for its recent tenders for spot cargoes.

India saw the start up of its seventh LNG import terminal in March as a commissioning cargo arrived at Dhamra LNG, taking total regasification capacity to 48m t/yr, but utilisation has been low and demand in 2023 is expected to be flat after 2022’s fall.

The IGU’s LNG report warns that projects in South Asia “face notable delays”, due to the spot price spikes globally in 2022 and downward pressure on economic development. This is leading to “a lack of incentives for investors” and poses “potential risks for the region’s LNG demand outlook”.

Several markets in Southeast Asia grew their LNG imports in 2022—among them Thailand, Malaysia, Indonesia and Singapore, where imports were up 19% to 3.7m t—but newly opened markets in the Philippines and Vietnam are not expected to import material volumes in 2023, partly because of their dependence on spot cargoes but also because some downstream customers are not yet ready to take gas.

In the established markets of Japan and South Korea, imports are expected to fall during 2023, as more nuclear power plants restart amid lower demand for power because of energy-saving efforts. Taiwan is phasing out nuclear power but faces LNG import capacity constraints.

The latest forecast from the IEA is that global LNG trade will grow by 4%, or 16m t/yr, during 2023, with growth largely driven by Asia-Pacific. It expects China’s demand to increase by 15% year-on-year, which would take it to 73m t/yr.

For 2024, the IEA sees a further 4%, or 17.5m t/yr, global increase—“well below the 8% average growth rate experienced between 2017 and 2021” as “below-average LNG liquefaction capacity additions are expected to prolong tight supply conditions into 2024”. Imports into Asia-Pacific are forecast to increase by 6%, mainly because of Chinese procurement through long-term contracts.

New waves of supply

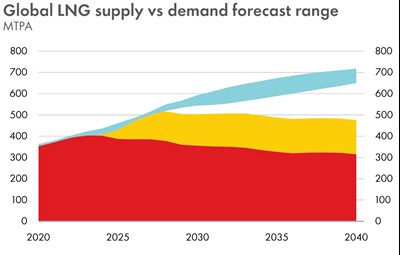

From 2024 onwards the global LNG supply-demand balance will start to ease as new waves of supply come onstream from the US, Canada, Qatar and elsewhere -- though the big waves of supply from the US and Qatar will not come until the second half of the decade.

The view of consultancy Wood Mackenzie’s LNG team is that “While contract prices are still relatively high, the balance of power is quickly shifting back towards the buyers. Spot prices have dropped 90% since the peak of 2022 and a wave of new supply is set to hit the market from 2025.

“Developers must stay focused on the long-term prize. The outlook is bullish, with another 100m t/yr of capacity required to meet demand growth by the mid-2030s, a 25% uplift to supply and on top of what’s already sanctioned.”

They add that developers should “double down on Asian markets” as the region’s developing economies “lean more heavily on gas while striving to move away from coal” because “Europe’s policy pivot away from gas limits upside for LNG suppliers beyond 2030”.

Pre-eminent US producer Cheniere Energy—which has plans to double its existing 45m t/yr of export capacity—points to ambitious 2030 gas growth targets in China and India and LNG-to-power targets in Taiwan, Vietnam and Thailand.

Shell, in its latest annual energy outlook, concurs with Wood Mackenzie’s view that—even with the new waves of supply coming onstream in the middle of the decade—more investment will be needed to avoid a supply-demand gap opening up before 2030, as Fig. 2 shows.

The outlook to 2050

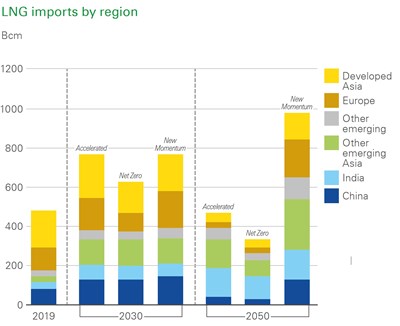

Projecting Asian LNG demand beyond 2030 is fraught with uncertainty and most of the organisations that publish forward-looking analysis rely on scenarios to address known unknowns.

The main ones are the pace of formulation and implementation of energy and climate policy—especially by the many nations, including in Asia-Pacific, that have made net-zero emissions (NZE) commitments—and the rate of advance of the technologies needed to realise net-zero GHG ambitions, such as CCUS and zero-carbon fuels including green hydrogen and ammonia.

One exception is the Gas Exporting Countries Forum (GECF), which has published an outlook to 2050 that takes the form of a—surprisingly bullish—forecast. The GECF expects LNG trade to grow to 850m t/yr by 2050, well above most other expectations, but its secretary general, Mohamed Hamel, acknowledges that “the uncertainties have never been so large and the challenges so profound”.

Other organisations, such as the IEA, BP and Shell, generally take a less definitive approach, preferring to construct a range of scenarios, generally making different assumptions about the pace of decarbonisation and progress towards NZE.

Fig. 3, which comes from the BP Energy Outlook 2023, shows how widely LNG demand outcomes in Asia-Pacific can vary under differing assumptions. The Accelerated and Net Zero scenarios assume the world takes action to reduce GHG emissions by 75% and 95%, respectively, by 2050 (relative to 2019 levels). The New Momentum scenario “is designed to capture the broad trajectory along which the global energy system is travelling”.

Surprisingly, developers of new liquefaction capacity appear to be undeterred by this level of uncertainty, especially those in Qatar and the US.

This article is part of our special LNG's role in resolving Asia's trilemma report, which looks at what the energy crisis means for LNG and what LNG's role is in resolving Asia's trilemma. Click here to download the full report, or visit the Gulf Energy Information stand (E326) at Gastech 2023 to pick up a copy.

Comments