While a number of commentators and analysts have begun to express doubts about the role that natural gas and LNG may play in Asia’s transition to cleaner energy over coming decades—among them the IEA—these doubts do not appear to be shared by most LNG liquefaction project developers and many buyers of their output.

In the short term, the industry has been galvanised by the crisis faced by Europe because of the loss of Russian pipeline gas supply, but there is consensus that European LNG demand will begin to wane once the crisis is over because of the bloc’s ambitious decarbonisation policies. Future LNG demand is expected to be largely centred on the emerging and developing economies of Asia-Pacific, especially China.

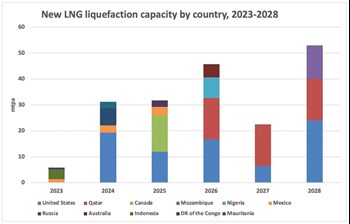

Research conducted by Petroleum Economist, shows that between now and the end of 2028 around 190m t/yr of new LNG export capacity is due to come on stream. To put that in context, LNG trade in 2022 was around 400m t so, at full utilisation, this would represent an increase of close to 50% over five years.

With a few exceptions—more about which below—the projects in the table have secured long-term offtake contracts for much of their output, reached FID and entered the construction phase. In 2021 and 2022, according to Shell’s LNG Outlook 2023, buyers signed up to around 140m t/yr of long-term offtake, with China, Europe and portfolio players accounting for the bulk of this.

“What we are seeing is buyers making a bet that demand is going to continue—with Chinese buyers signing up to 27-year contracts which take them through to 2053,” says independent consultant Andy Flower.

The heavy involvement of portfolio players, which accounted for around 56m t/yr of long-term SPAs in 2021–22, is significant because they tend to be big investors in LNG export projects and because of the role they play as intermediaries between supply projects, which generally seek long-term stability of offtake to underpin financing, and buyers, some of which may place greater value on flexibility.

FIG.1: LNG export projects due to start up by 2028

US leads the field

The clear leader in LNG export capacity expansion over the coming five years is the US, which this year is expected to become the world’s top LNG exporter. It has several large projects under construction, with a long pipeline of projects jostling to reach FID.

The seven projects operating in the US have aggregate capacity of 91.3m t/yr, significantly more than Qatar’s 77.4m t/yr and just above Australia’s 87.2m t/yr. Projects under construction will give the US another 78.6m t/yr of capacity by 2028, taking the total to 160m t/yr if projects proceed without delays.

There is also a long list of US projects that have received approvals for construction, operation and export but not yet reached FID. These amount to a further 148m t/yr of capacity, though how much of that will actually get built remains to be seen.

Beyond these, there are projects that have yet to be permitted, some of which have been proposed by credible existing players, such as Cheniere Energy—the pre-eminent US LNG exporter, which has 45m t/yr in operation.

North Field Expansion

In second place, way ahead of the rest of the pack, is Qatar. It already has 14 trains in operation with nameplate capacity of 77.4m t/yr and is now developing what it calls the North Field Expansion project. This will add another six 8m t/yr mega-trains, taking Qatar’s total capacity to 126m t/yr by 2027–28.

FID on the first four trains, which make up the $29b North Field East (NFE) project, was reached by QatarEnergy in February 2021, with five foreign partners appointed over a period of weeks in the middle of 2022: ConocoPhillips, Eni, ExxonMobil, Shell and TotalEnergies. Completion of partner selection left QatarEnergy with 75% of the entire project.

FID has yet to be reached on the final two trains, the North Field South (NFS) project, but QatarEnergy has been proceeding with the project as though FID had been reached.

The appointment of foreign partners—ConocoPhillips, Shell and TotalEnergies—was completed in October 2022, again leaving QatarEnergy with 75%, and an EPC contract for the onshore facilities was signed in May 2023.

The $10b EPC price tag for two LNG mega-trains and associated facilities underscored the competitiveness of Qatar LNG at a time when US projects are facing mounting costs. It remains unclear as to why FID on NFS has yet to be announced.

More in the pipeline?

Saad Sherida Al-Kaabi, Qatar’s minister of state for energy affairs and president and CEO of QatarEnergy, has said Qatar’s LNG ambitions may extend beyond the North Field Expansion but has yet to give any details.

What is unusual about the Qatari projects is that, so far, little of the 48m t/yr of new capacity has been sold under long-term SPAs. The first SPA for NFE, a 4m t/yr, 27-year deal with China’s Sinopec, was not announced until November 2022.

In April 2023, Sinopec became the first Chinese company to take a stake in a Qatari liquefaction project—the equivalent of a 5% interest in one of NFE’s four trains— setting a precedent that signalled a growing mutual dependence between one of the world’s largest LNG producers and one of its largest importers.

A similar deal was signed with China National Petroleum Corporation (CNPC) in June, when it agreed to take 4m t/yr from NFE and a 5% stake in one of the trains. Earlier in June, Bangladesh’s Petrobangla signed up to offtake 1.8m t/yr from NFE for a period of 15 years. No SPAs have yet been announced for NFS.

Kaabi said in June that discussions were under way with several Asian countries for offtake/equity deals similar to those signed with Sinopec and CNPC, adding that such deals would not affect the stakes of existing partners.

Troubled projects

Two of the largest post-FID projects that are nominally under construction have large question marks hanging over them.

Novatek’s Arctic LNG 2 project in Russia is one of them, because several western firms have walked away due to sanctions imposed following the invasion of Ukraine—including EPC contractor Technip Energies.

Construction is nearing completion on the first of three 6.6m t/yr trains, but there have been reports that work on trains two and three has ceased. The start-up date of even the first train is uncertain, given the disruptions, but it could be around the turn of 2023. It was originally due to come onstream in 2022.

The other troubled project is Mozambique LNG, construction of which was halted in April 2021 when TotalEnergies declared force majeure because of the worsening security situation in the north of the country.

Efforts are under way to resurrect the project, but questions remain as to whether engineering contractors will stick to their original cost estimates despite several years of cost inflation. If that deadlock is resolved, the financing will then have to be revived. TotalEnergies’ CEO Patrick Pouyanne recently told analysts: “My goal is to provide you with clarity on the way forward before the year ends.”

The situation around Arctic LNG 2 has contributed to the tight LNG supply/demand balance expected over the next couple of years and any further problems with bringing the first train on stream would compound that.

As for Mozambique LNG, that will not start up until 2027/28 at best, by which time the global LNG market may well be facing a glut if the US LNG stampede continues.

This article is part of our special LNG's role in resolving Asia's trilemma report, which looks at what the energy crisis means for LNG and what LNG's role is in resolving Asia's trilemma. Click here to download the full report, or visit the Gulf Energy Information stand (E326) at Gastech 2023 to pick up a copy.

Comments