Broker launches insurance against carbon leakage

London-based Howden says new product can boost bankability of CCS projects by addressing key risk

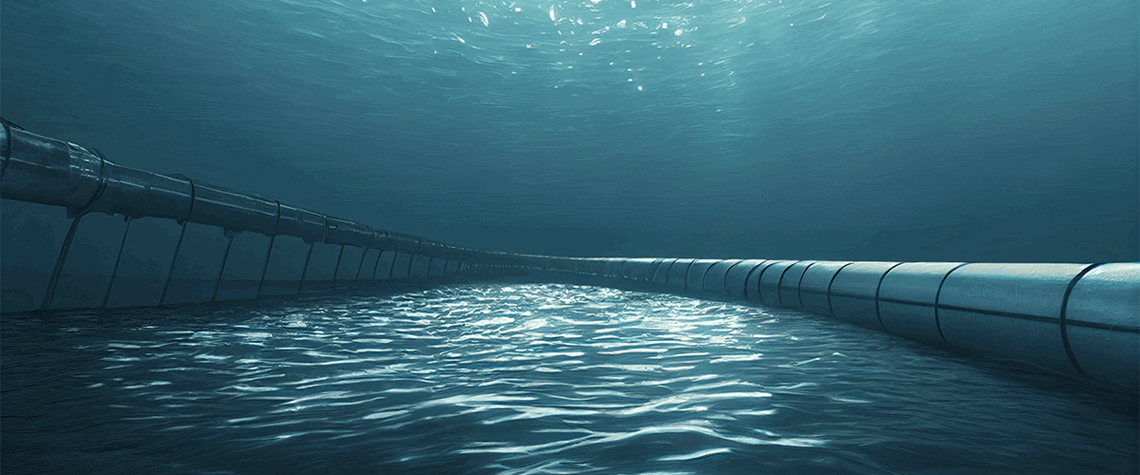

London-based broker Howden has launched an insurance facility covering leakage of CO₂ from commercial-scale CCS projects in a move designed to help unlock investment by addressing one of the sector’s key risks. The insurance facility, which Howden says is the first of its type, provides cover for environmental damage and loss of revenue arising from the sudden or gradual leakage of CO₂ from CCS projects into the air, land and water. Leakage could lead to CCS projects being unable to fulfil emission reduction commitments made against offsets or allowances issued in cap-and-trade markets. The insurance product is also designed to support the development of a commercial insurance market for lea

Also in this section

11 August 2025

US company reiterates commitment to CCUS as it agrees to work with major steelmakers to drive large-scale deployment in Asia

7 August 2025

Draft law opens door to large-scale carbon capture and storage, and could unleash investment in gas-based hydrogen projects

6 August 2025

EU industry and politicians are pushing back against the bloc’s green agenda. Meanwhile, Brussels’ transatlantic trade deal with Washington could consolidate US energy dominance

22 July 2025

Sinopec hosts launch of global sharing platform as Beijing looks to draw on international investors and expertise