Offset oversupply threatens carbon removal tech

Surplus offsets in voluntary carbon market could depress prices to 2050 and deter investment in more expensive removal methods, says BloombergNEF

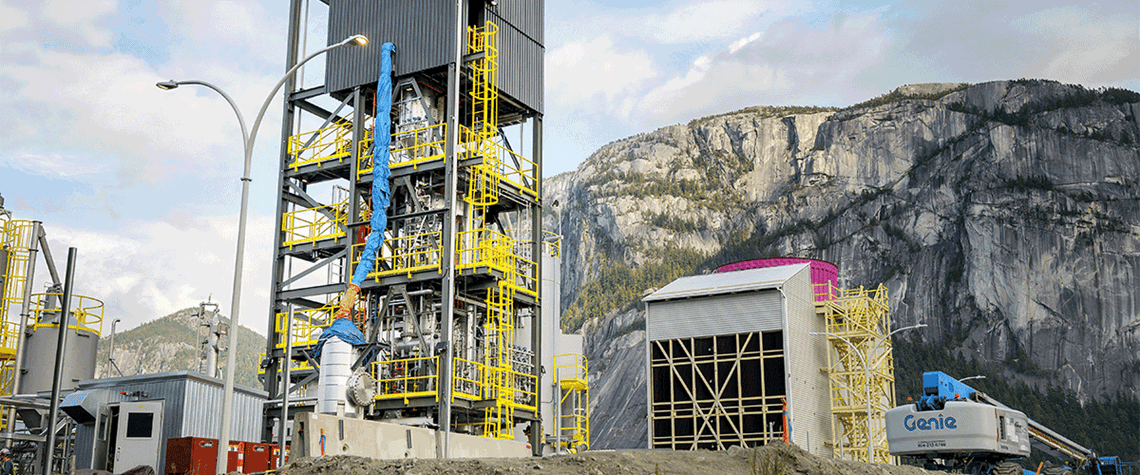

Carbon-removal technologies including direct air capture (DAC) and bioenergy with carbon capture (Beccs) could miss out on the investment needed to scale them up over the coming decades because of oversupply in the voluntary offset market, according to research firm BloombergNEF. In a scenario where the dynamics of the voluntary market remain as they are today, oversupply could result in offset prices in 2050 being as low as $35/t. This would mean marginal demand for offsets, even as demand peaks in 2050, could be met by much cheaper credits from lower-quality projects, effectively pricing DAC and Beccs out of the market, BloombergNEF analysts told a recent presentation of the firm’s Volunta

Also in this section

7 August 2025

Draft law opens door to large-scale carbon capture and storage, and could unleash investment in gas-based hydrogen projects

6 August 2025

EU industry and politicians are pushing back against the bloc’s green agenda. Meanwhile, Brussels’ transatlantic trade deal with Washington could consolidate US energy dominance

22 July 2025

Sinopec hosts launch of global sharing platform as Beijing looks to draw on international investors and expertise

22 July 2025

Africa’s most populous nation puts cap-and-trade and voluntary markets at the centre of its emerging strategy to achieve net zero by 2060