Energy Council sees worsening underinvestment in oil and gas

But CEO Miller says surge in Middle East and Asia funding, creative solutions and ‘nuanced’ approach to transition offer hope

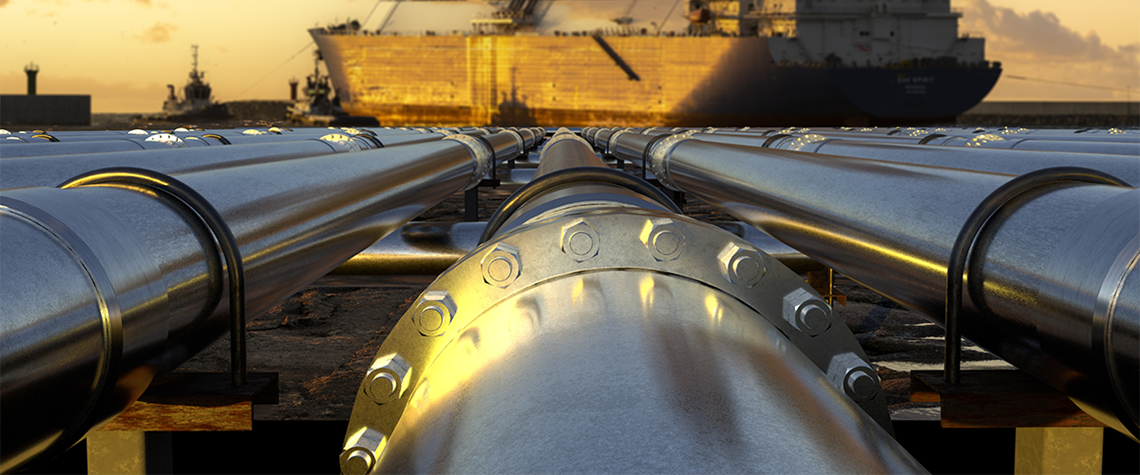

Financing oil and gas projects has become the industry’s Achilles’ heel, leading to chronic underinvestment. Speaking to Petroleum Economist, Energy Council CEO Amy Miller warned that, while the trend is likely to worsen, a surge in funding from the Middle East and Asia, creative solutions, and tying projects to energy transition goals all provide pathways to success. Miller talked up the crucial role that gas will play in the long run, not just in terms of a stable and secure supply but also in meeting decarbonisation goals. The Energy Council, which connects executives to finance energy investments and hosts the World Energy Capital Assembly in November, sees a huge role for the oil and ga

Also in this section

4 March 2026

The US president has repeatedly promised to lower gasoline prices, but this ambition conflicts with his parallel aim to increase drilling and could be upended by his war against Iran

4 March 2026

With the Strait of Hormuz effectively closed following US-Israel strikes and Iran’s retaliatory escalation, Fujairah has become the region’s critical pressure release valve—and is now under serious threat

3 March 2026

The killing of Iran’s Supreme Leader Ayatollah Khamenei in US–Israeli strikes marks the most serious escalation in the region in decades and a bigger potential threat to the oil market than the start of the Russia-Ukraine crisis

2 March 2026

A potential blockade of the Strait of Hormuz following the escalating US-Iran conflict risks disrupting Qatari LNG exports that underpin global gas markets, exposing Asia and other markets to sharp price spikes, cargo shortages and renewed reliance on dirtier fuels