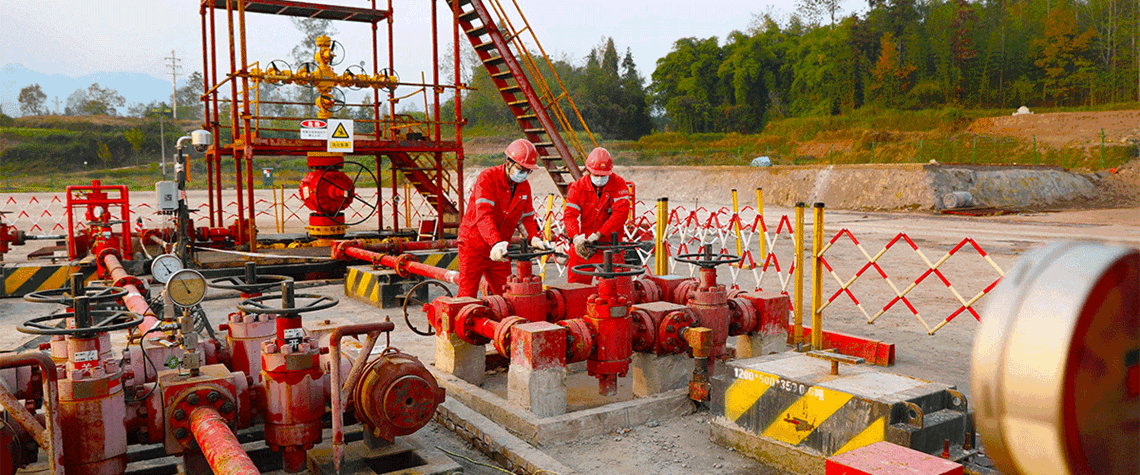

China’s gas goals face unconventional hurdles

Beijing’s strong emphasis on domestic production growth will require heavier investment from the country’s NOCs, as remaining reserves become harder to exploit

China’s domestic gas output will continue to grow for the rest of this decade, as the country’s energy giants eke out greater production at prolific legacy fields. But later gains could become harder to come by, as upstream development will eventually have to shift to complex frontier plays, both onshore and offshore, that are more challenging to exploit. China has managed to increase gas output by more than 10bcm/yr for the past six years, a streak the central government is keen to continue. PetroChina, Sinopec and CNOOC—which together accounted for 83% of gas produced in China in the first nine months of this year—have persistently sustained or increased domestic investment, under governme

Also in this section

5 March 2026

Gas is a central pillar of Colombia’s energy system, but declining production poses a significant challenge, and LNG will be increasingly needed as a stopgap. A recent major offshore gas discovery offers hope, but policy improvements are also required, Camilo Morales, secretary general of Naturgas, the Colombian gas association, tells Petroleum Economist

4 March 2026

The continent’s inventories were already depleted before conflict erupted in the Middle East, causing prices to spike ahead of the crucial summer refilling season

4 March 2026

The US president has repeatedly promised to lower gasoline prices, but this ambition conflicts with his parallel aim to increase drilling and could be upended by his war against Iran

4 March 2026

With the Strait of Hormuz effectively closed following US-Israel strikes and Iran’s retaliatory escalation, Fujairah has become the region’s critical pressure release valve—and is now under serious threat