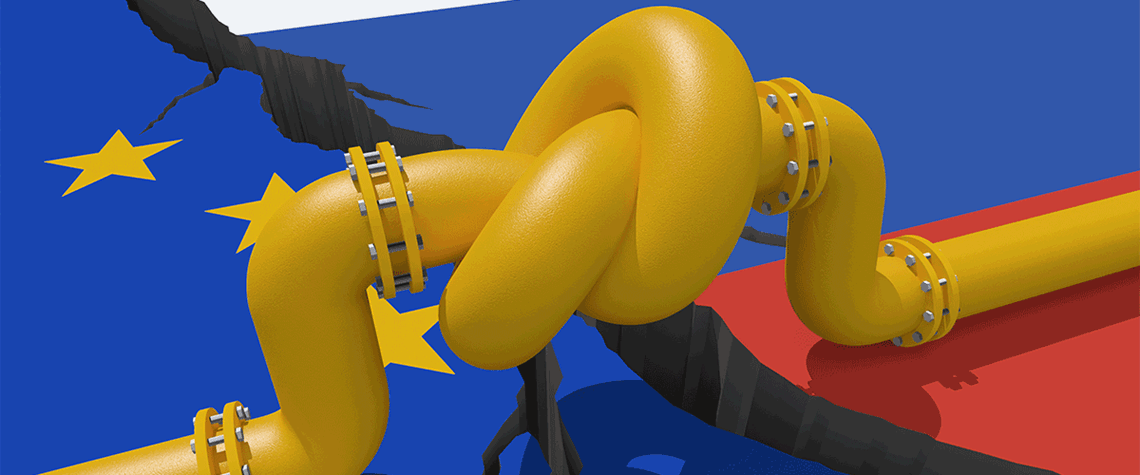

Global gas market reawakened by ‘Russia effect’

Industry takes fresh look at moribund, risky or questionable gas and LNG projects

The ‘Structures A and E’ project off the Libyan coast is as prosaic as its name implies, holding an unspectacular 6tn ft³ (170bn m³) of gas. Plans to extract it date from 2008, but the operator, Italy’s Eni, had been content to leave it in the ground given the upheaval in Libya. That upheaval has not gone away: the country has two rival governments, militias rule the capital and its National Oil Corporation is riven with infighting. But in January, Eni cast those worries aside and announced it was developing Structures A and E. One big reason is the ‘Russia effect’—Europe’s thirst for new gas following the imposition of sanctions on Moscow. Russia supplied half of Europe’s gas before its inv

Also in this section

27 February 2026

LNG would serve as a backup supply source as domestic gas declines and the country’s energy system comes under stress during periods of low hydropower output and high energy demand

27 February 2026

The assumption that oil markets will re-route and work around sanctions is being tested, and it is the physical infrastructure that is acting as the constraint

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

27 February 2026

The deepwater sector must be brave by fast-tracking projects and making progress to seize huge offshore opportunities and not become bogged down by capacity constraints and consolidation