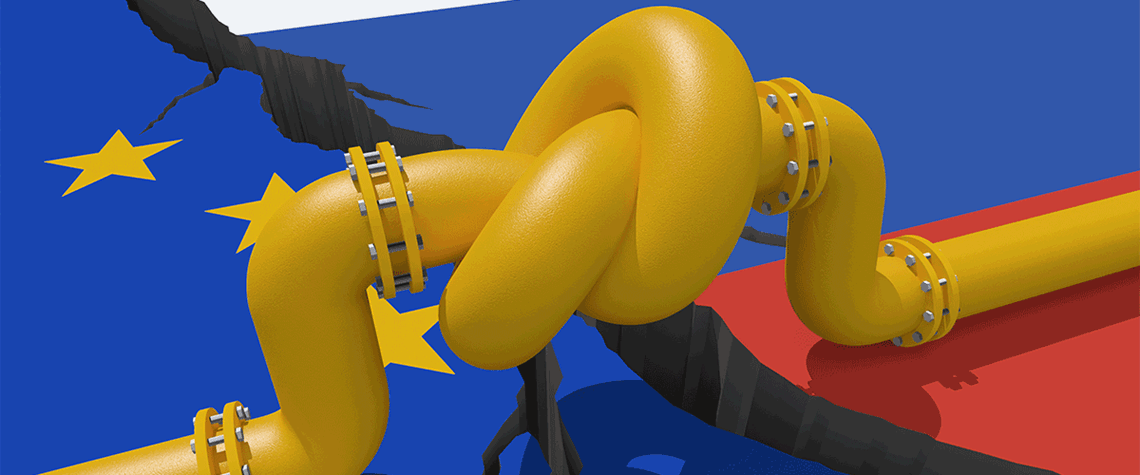

Global gas market reawakened by ‘Russia effect’

Industry takes fresh look at moribund, risky or questionable gas and LNG projects

The ‘Structures A and E’ project off the Libyan coast is as prosaic as its name implies, holding an unspectacular 6tn ft³ (170bn m³) of gas. Plans to extract it date from 2008, but the operator, Italy’s Eni, had been content to leave it in the ground given the upheaval in Libya. That upheaval has not gone away: the country has two rival governments, militias rule the capital and its National Oil Corporation is riven with infighting. But in January, Eni cast those worries aside and announced it was developing Structures A and E. One big reason is the ‘Russia effect’—Europe’s thirst for new gas following the imposition of sanctions on Moscow. Russia supplied half of Europe’s gas before its inv

Also in this section

1 August 2025

A number of companies have filed arbitration claims against Gazprom over non-deliveries of contracted gas or other matters—and won. The next step is to collect the award; this is no easy task but it can be done thanks to an international legal framework under the New York Convention.

1 August 2025

Europe’s refining sector is desperately trying to adapt to a shifting global energy landscape and nowhere is this more apparent than in its largest economy

1 August 2025

The Middle East natural gas playbook is being rewritten. The fuel source offers the region a pathway to a cleaner, sustainable and affordable means of local power, to fasttrack economic development and as a lucrative opportunity to better monetise its energy resources.

31 July 2025

TotalEnergies is an outlier among other majors for remaining committed to low-carbon investments while continuing to replenish and expand its ample oil and gas portfolio, with an appetite for high risk/high return projects.