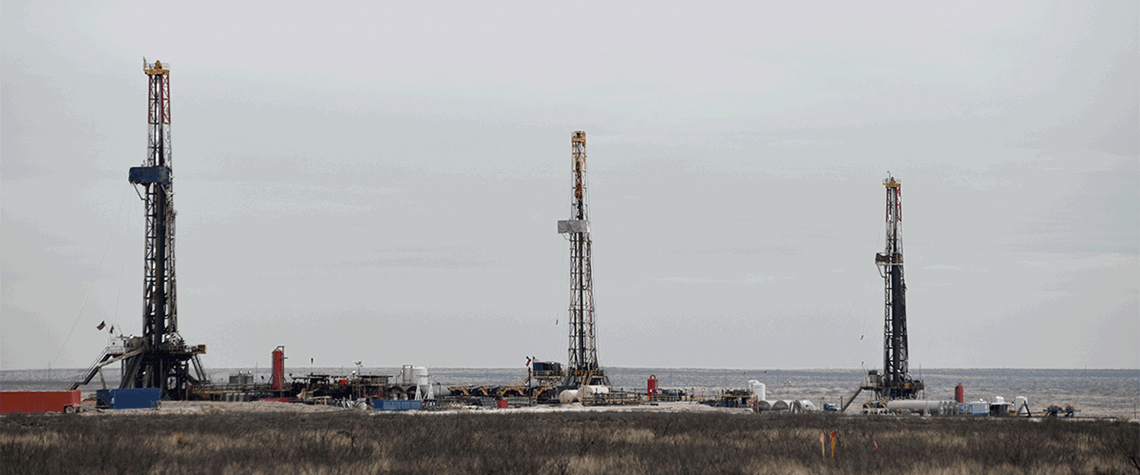

Shale drillers try to stay patient amid gas price slump

Producers resist urge to respond too quickly to gas price trends

US shale drillers are keeping their plans unchanged for now as they ride the peaks and troughs of gas price volatility. Prices spiked last year in the wake of Russia’s invasion of Ukraine but have since dropped back to pre-war levels, and analysts question whether the industry has learned lessons from the past—when quick responses to price changes have left producers playing catch-up. Certainly, the industry remains sensitive to price signals, and further fluctuations will shape how gas drilling plays out over the remainder of 2023 and beyond. Various other factors will also have an impact on behaviour, however, including how companies are structured and what their asset mixes look like. Whi

Also in this section

23 February 2026

The country’s upstream players have demonstrated resilience to low oil prices and are well positioned to prosper despite a volatile market

20 February 2026

The country is pushing to increase production and expand key projects despite challenges including OPEC+ discipline and the limitations of its export infrastructure

20 February 2026

Europe has transformed into a global LNG demand powerhouse over the last few years, with the fuel continuing to play a key role in safeguarding the continent’s energy security, Carsten Poppinga, chief commercial officer at Uniper, tells Petroleum Economist

20 February 2026

Sempra Infrastructure’s vice president for marketing and commercial development, Carlos de la Vega, outlines progress across the company’s US Gulf Coast and Mexico Pacific Coast LNG portfolio, including construction at Port Arthur LNG, continued strong performance at Cameron LNG and development of ECA LNG