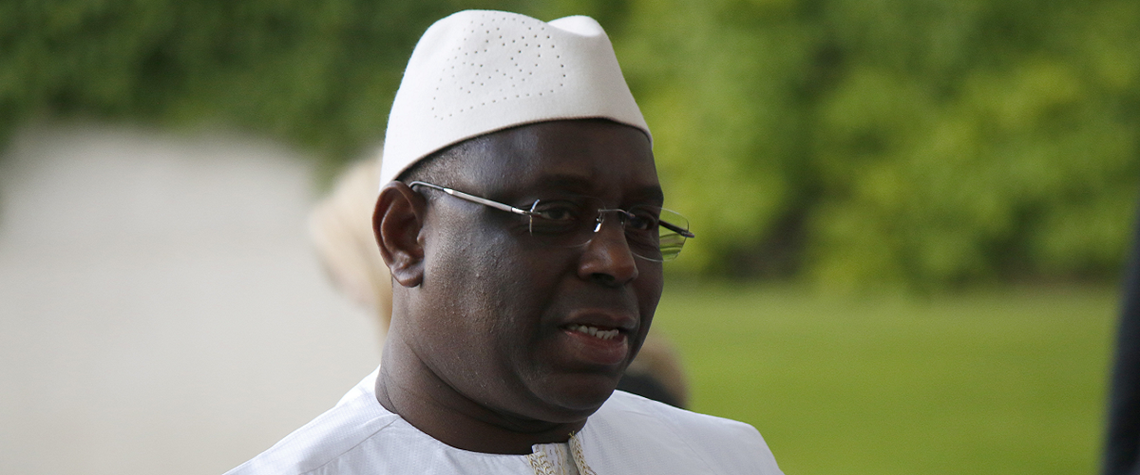

Senegal and Guinea-Bissau deal faces domestic pressures

Guinea-Bissau is eager to kick start exploration in acreage shared with oil-rich Senegal, but it’s slow going

Guinea-Bissau and Senegal made good early progress in talks to revise the agreement sharing out potential oil and gas revenue from their joint offshore exploration zone. But with both governments under domestic pressure, a scheduled negotiating round in late August was postponed without agreeing a resumption date. The original 1993 deal allocated Guinea-Bissau a mere 15% of any future hydrocarbon revenue from the Agence pour la gestion et la coopération (AGC) zone's 25,000 sq km (9,650 square miles) of continental shelf. The administration of President Kumba Yala, in power from 2000 to 2003, persuaded Senegal that his country's share should, in principle, be increased to 25%, but this deal

Also in this section

11 August 2025

The administration is pushing for deregulation and streamlined permitting for natural gas, while tightening requirements and stripping away subsidies from renewables

8 August 2025

The producers’ group missed its output increase target for the month and may soon face a critical test of its strategy

7 August 2025

The quick, unified and decisive strategy to return all the barrels from the hefty tranche of cuts from the eight producers involved in voluntary curbs signals a shift and sets the tone for the path ahead

7 August 2025

Without US backing, the EU’s newest sanctions package against Russia—though not painless—is unlikely to have a significant impact on the country’s oil and gas revenues or its broader economy