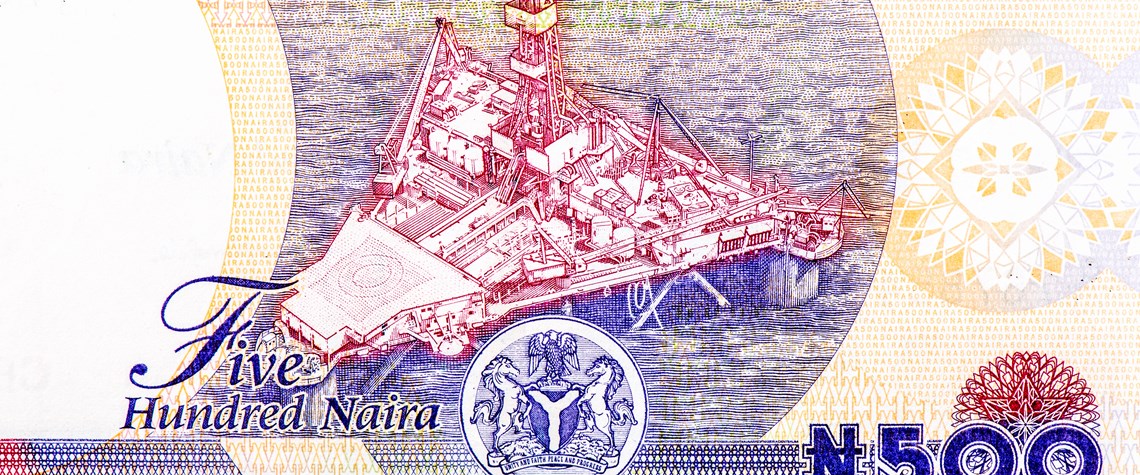

Nigeria dangerously exposed to oil crash

The recent drop in oil prices will hit Nigeria hard, making a big dent in government revenues and threatening the viability of upstream projects

Nigeria is bracing to take a big hit from the collapse in oil prices resulting from the end of the Opec+ agreement and the Covid-19 pandemic. The country is particularly vulnerable as it has not fully recovered from the previous crash in 2014. Nigeria’s 2020 budget is based on an anticipated oil price of $57/bl, but the decline in the price of the Brent benchmark crude has forced the government to revise this to $30/bl while maintaining proposed production volumes at 2.18mn bl/d. The crash in prices means volume is especially important for oil-dependent Nigeria, and as there will be no Opec output limits to adhere to after March, the country can pump at will. However, in the medium-to-long t

Also in this section

20 February 2026

The country is pushing to increase production and expand key projects despite challenges including OPEC+ discipline and the limitations of its export infrastructure

20 February 2026

Europe has transformed into a global LNG demand powerhouse over the last few years, with the fuel continuing to play a key role in safeguarding the continent’s energy security, Carsten Poppinga, chief commercial officer at Uniper, tells Petroleum Economist

20 February 2026

Sempra Infrastructure’s vice president for marketing and commercial development, Carlos de la Vega, outlines progress across the company’s US Gulf Coast and Mexico Pacific Coast LNG portfolio, including construction at Port Arthur LNG, continued strong performance at Cameron LNG and development of ECA LNG

19 February 2026

US LNG exporter Cheniere Energy has grown its business rapidly since exporting its first cargo a decade ago. But Chief Commercial Officer Anatol Feygin tells Petroleum Economist that, as in the past, the company’s future expansion plans are anchored by high levels of contracted offtake, supporting predictable returns on investment