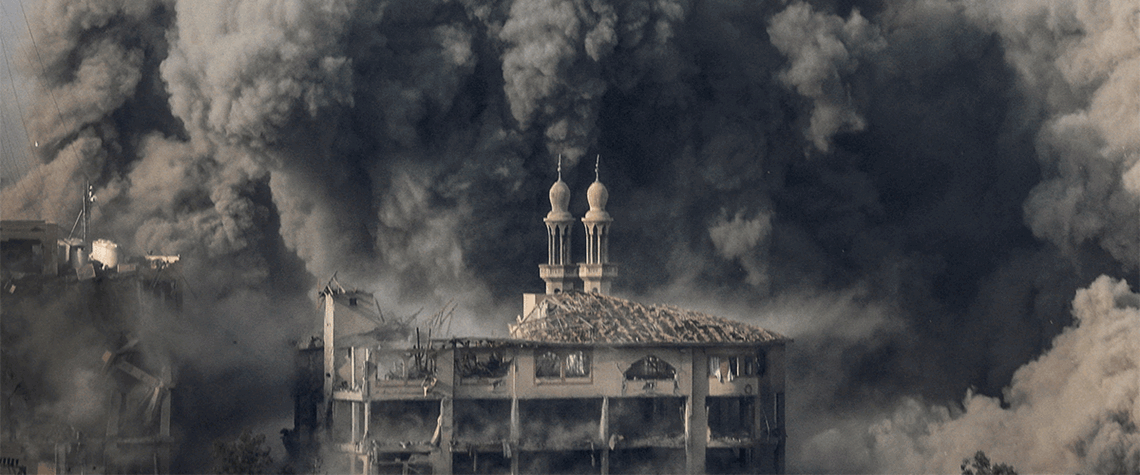

Israel-Hamas war clouds energy prospects

The threat of a big disruption to energy trade in the Middle East appears to be receding, but the fog of war is casting doubt on projects in the region

The war in Gaza may still escalate beyond the borders of Israel and the Palestinian territories and cause major energy disruptions, but the likelihood of this appeared to have receded by early December as a ceasefire came and went and hostilities remained largely constrained to the Gaza Strip and surrounding areas. Instead, experts say, different tracks of negotiations are picking up, with the entire Middle East in flux and Qatar’s status in particular elevated—as both an energy powerhouse and a geopolitical deal maker. Global oil and gas prices spiked immediately after the surprise attack by Hamas on 7 October, which claimed more than 1,200 Israeli lives and disrupted regional energy trade.

Also in this section

21 August 2025

The administration has once more reduced its short-term gas price forecasts, but the expectation remains the market will tighten over the coming year, on the back of

19 August 2025

ExxonMobil’s MOU with SOCAR, unveiled in Washington alongside the peace agreement with Armenia, highlights how the Karabakh net-zero zone is part of a wider strategic realignment

19 August 2025

OPEC and the IEA have very different views on where the oil market is headed, leaving analysts wondering which way to jump

15 August 2025

US secondary sanctions are forcing a rapid reassessment of crude buying patterns in Asia, and the implications could reshape pricing, freight and supply balances worldwide. With India holding the key to two-thirds of Russian seaborne exports, the stakes could not be higher