Continental storage divide

European oil storage struggles as new facilities aid further growth in Asia

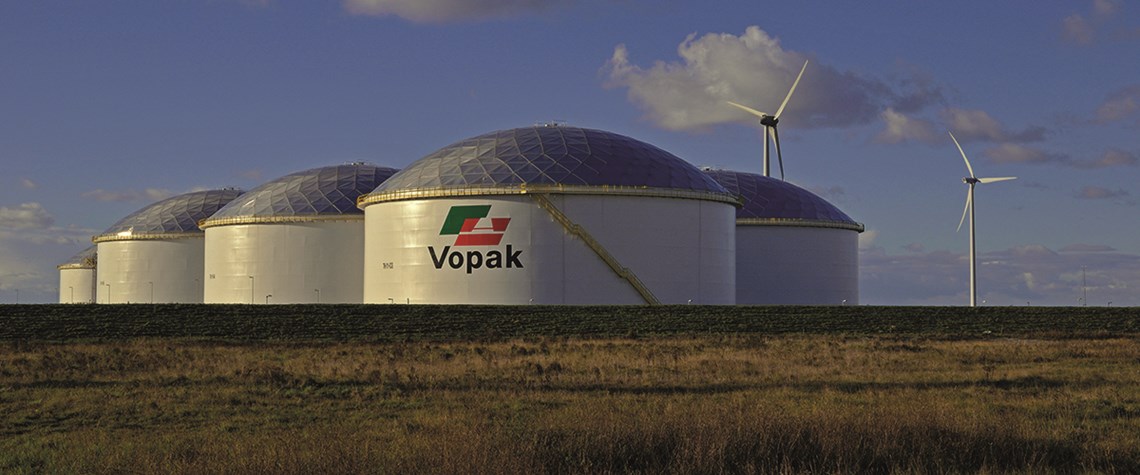

In this article, PE looks at the evolution of storage trends in the industry. Part II of II. European oil storage activity this year has been heavily affected by the market backwardation. By late September, Brent crude futures prices were backwardated by 20-50 cents per barrel for all delivery months, while gasoil futures prices were showing monthly backwardation of up to $3.25 a tonne along the forward price curve. Such structures removed most incentives for speculative product storage. According to the IEA, European commercial oil inventories declined to 959m barrels at the end of June from 999m barrels at the end-June 2017. The trend towards lower inventories appears to have been consiste

Also in this section

27 February 2026

LNG would serve as a backup supply source as domestic gas declines and the country’s energy system comes under stress during periods of low hydropower output and high energy demand

27 February 2026

The assumption that oil markets will re-route and work around sanctions is being tested, and it is the physical infrastructure that is acting as the constraint

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

27 February 2026

The deepwater sector must be brave by fast-tracking projects and making progress to seize huge offshore opportunities and not become bogged down by capacity constraints and consolidation