Downturn hits Latin America’s upstream hard

Worsening economic conditions set to slash oil production growth in the region

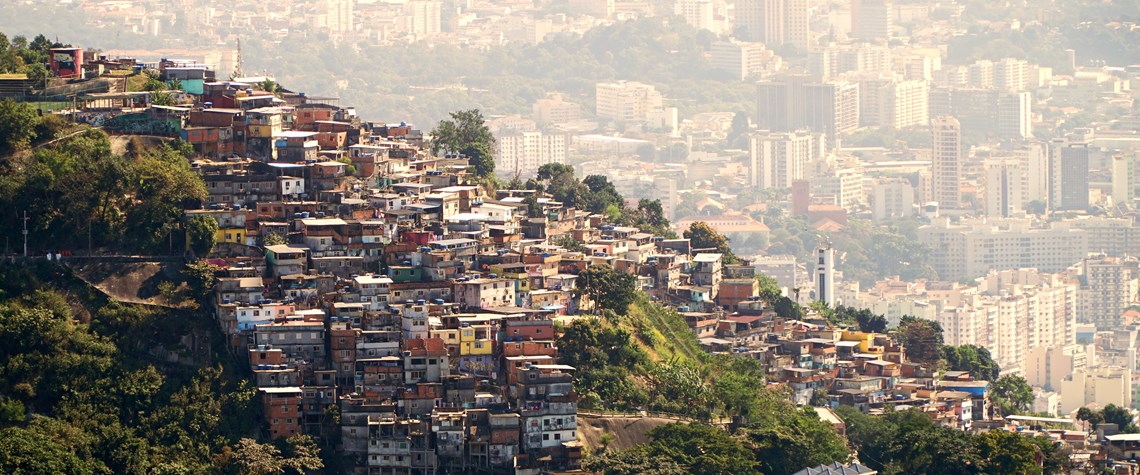

The Opec+ collapse is leading to an unprecedented wave of crude hitting the market just as demand plunges due to the Covid-19 pandemic. Latin American government revenues will take a big hit because of the outsized role that oil and gas plays in regional economies. As elsewhere, companies active in the region have reacted quickly, making deep cuts to their capital spend plans for this year, with discretionary spend being pulled back wherever possible. Current oil prices may not be sustainable beyond the short-term, but the focus for companies is to minimise cash burn and protect their balance sheets. Production will be hit, and short-term shut-ins have already begun. Longer-term growth will

Also in this section

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true