Oil India sets ambitious drilling target

The state-owned firm will drill 60 wells in the current financial year as India strives to reduce its import dependence

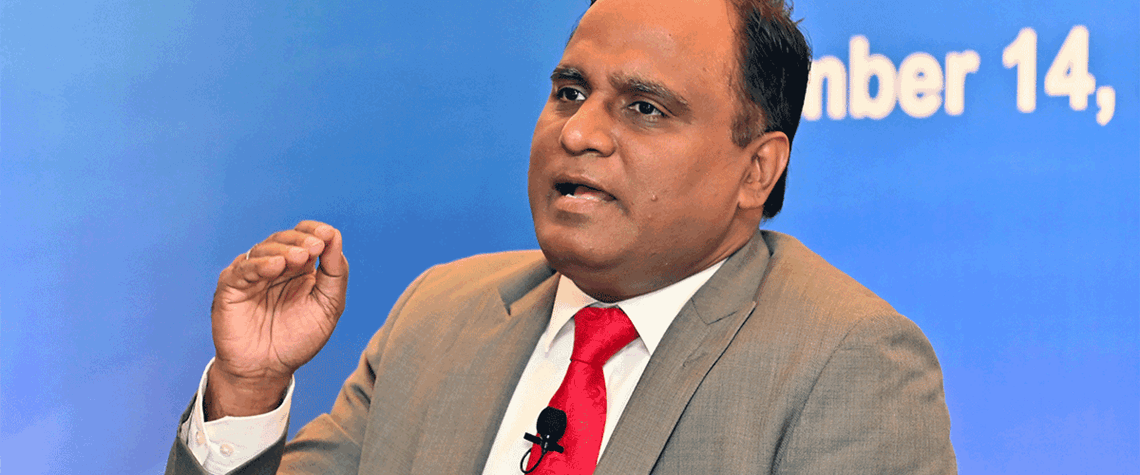

India’s E&P companies are facing enormous pressure from all quarters to leave no stone unturned in their efforts to increase the country’s domestic crude output and reduce its ever-widening oil import bill. State-owned Oil India Limited (OIL) has announced it will drill 60 wells in the current financial year (April 2023–March 2024), a 33.33% increase compared with the previous financial year. India is highly dependent on the imports of crude oil to meet its domestic demand. The country imported 86.4% of its crude in the 2022–23 financial year. “Fulfilling the vision of Urja Atmanirbharta [energy self-reliance] for a new India, OIL’s strategy is to consolidate its position as the leading

Also in this section

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true

25 February 2026

The surge in demand for fuel and petrochemical products in Asia has led to significant expansion in refining and petrochemicals capacities, with India and China leading the way