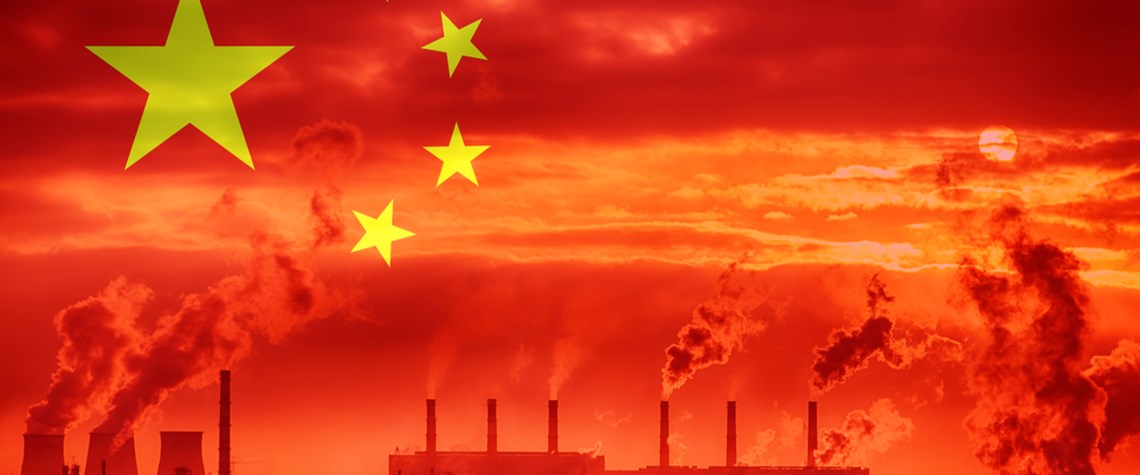

China ETS carbon prices rally to record highs

Allowance prices rise 34% since start of year as regulator imposes tighter limits and considers reduction of free allocations

China’s ETS has passed a milestone after the spot price of carbon allowances topped RMB100/t ($13.8/t) for the first time since it opened for business nearly three years ago. The rising price and potentially fewer credits available for trading could benefit renewable energy providers by incentivising more demand for green power from emitters that will soon be covered by the ETS. China’s ETS covers only the power generation sector, with more than 2,000 mostly coal-fired plants included in the scheme. The power plants account for about 40% of national emissions. Each participating power plant is allocated free allowances every year based on the benchmark emission intensity of 0.818/t of CO₂/MW

Also in this section

7 August 2025

Draft law opens door to large-scale carbon capture and storage, and could unleash investment in gas-based hydrogen projects

6 August 2025

EU industry and politicians are pushing back against the bloc’s green agenda. Meanwhile, Brussels’ transatlantic trade deal with Washington could consolidate US energy dominance

22 July 2025

Sinopec hosts launch of global sharing platform as Beijing looks to draw on international investors and expertise

22 July 2025

Africa’s most populous nation puts cap-and-trade and voluntary markets at the centre of its emerging strategy to achieve net zero by 2060