Surging battery mineral prices threaten EV growth

EV sales growth remains robust in 2022, but rising mineral prices and supply chain dislocations present near-term challenges, says IEA

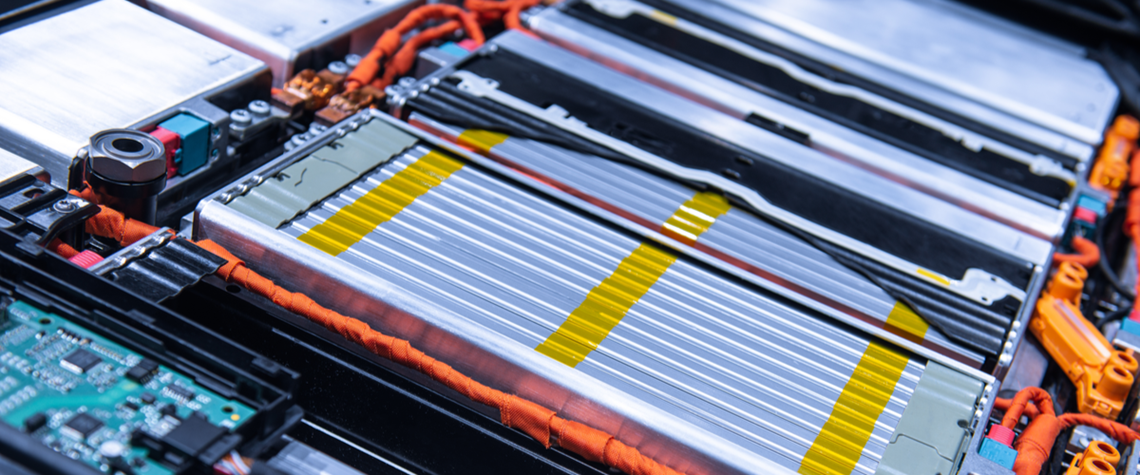

Sales of electric vehicles (EV) remain strong so far this year, but the market faces significant near-term headwinds in the form of soaring mineral prices and supply chain disruptions, according to the IEA. Prices for lithium, a crucial mineral used in car batteries, were over seven times higher in May 2022 than at the start of 2021, and prices for cobalt and nickel also rose, the IEA notes. All else being equal, the cost of battery packs could increase by 15pc if these prices stay around current levels—reversing several years of declines. Russia’s invasion of Ukraine has created further pressures, since Russia supplies 20pc of global battery-grade nickel. Continued Covid-19 lockdowns in som

Also in this section

9 January 2026

A shift in perspective is needed on the carbon challenge, the success of which will determine the speed and extent of emissions cuts and how industries adapt to the new environment

2 January 2026

This year may be a defining one for carbon capture, utilisation and storage in the US, despite the institutional uncertainty

23 December 2025

Legislative reform in Germany sets the stage for commercial carbon capture and transport at a national level, while the UK has already seen financial close on major CCS clusters

15 December 2025

Net zero is not the problem for the UK’s power system. The real issue is with an outdated market design in desperate need of modernisation