OGCI members cut emissions

Big oil and gas firms are making progress on carbon intensity and methane emissions

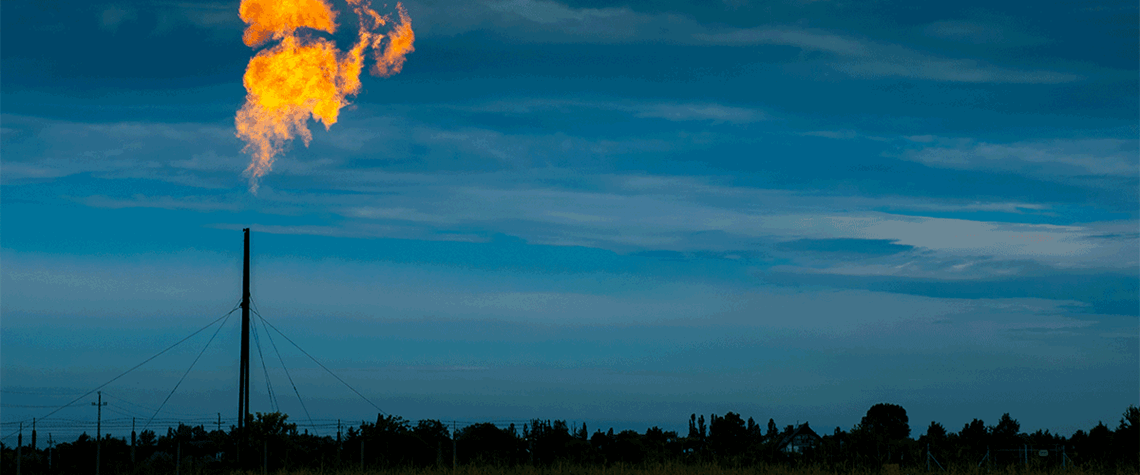

The 12 member companies of the Oil and Gas Climate Initiative (OGCI) have reduced their upstream methane emissions by 44pc and scope one carbon emissions by 18pc since 2017, according to the initiative’s annual report, published today. The OGCI members are Saudi state-owned Aramco, Chinese state-controlled CNPC, Italy’s Eni, Norwegian state-owned Equinor, US superindie Occidental Petroleum, Brazilian NOC Petrobras, Spain’s Repsol, and majors ExxonMobil, BP, Chevron, Shell and TotalEnergies. The aggregate methane intensity of OGCI member companies is now 0.17pc, down from 0.3pc from the baseline year of 2017 and well below the 2025 target of 0.2pc. “Eliminating methane emissions from oi

Also in this section

22 July 2025

Sinopec hosts launch of global sharing platform as Beijing looks to draw on international investors and expertise

22 July 2025

Africa’s most populous nation puts cap-and-trade and voluntary markets at the centre of its emerging strategy to achieve net zero by 2060

17 July 2025

Oil and gas companies will face penalties if they fail to reach the EU’s binding CO₂ injection targets for 2030, but they could also risk building underused and unprofitable CCS infrastructure

9 July 2025

Latin American country plans a cap-and-trade system and supports the scale-up of CCS as it prepares to host COP30