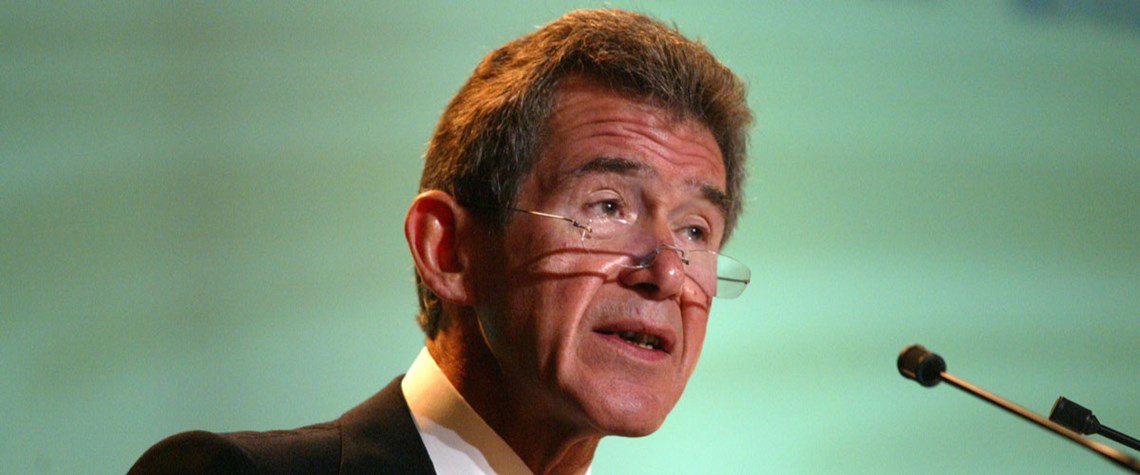

Oil firms should separate fossil and low-carbon businesses – Browne

World undergoing disorderly energy transition that could be delayed by spiking fossil fuel prices, says former BP CEO John Browne

Oil and gas companies should take bolder steps to separate their low-carbon and fossil fuel businesses, former BP CEO John Browne told an energy event today. Browne, who now chairs US private equity firm General Atlantic’s climate venture Beyond Netzero, says a separation of the businesses would give clarity on companies’ commitment to renewables, especially when high prices offer better returns from investment in fossil fuels. “When oil prices were last at $100/bl, oil companies diverted capital away from their nascent renewable energy businesses and actually put it back to work in hydrocarbons in pursuit of return. They maintained a rhetorical commitment to renewables but, in practice, did

Also in this section

22 July 2025

Sinopec hosts launch of global sharing platform as Beijing looks to draw on international investors and expertise

22 July 2025

Africa’s most populous nation puts cap-and-trade and voluntary markets at the centre of its emerging strategy to achieve net zero by 2060

17 July 2025

Oil and gas companies will face penalties if they fail to reach the EU’s binding CO₂ injection targets for 2030, but they could also risk building underused and unprofitable CCS infrastructure

9 July 2025

Latin American country plans a cap-and-trade system and supports the scale-up of CCS as it prepares to host COP30