UK eyes Cbam as net-zero push accelerates

Government consults on measures to tackle carbon leakage as it ramps up domestic decarbonisation efforts

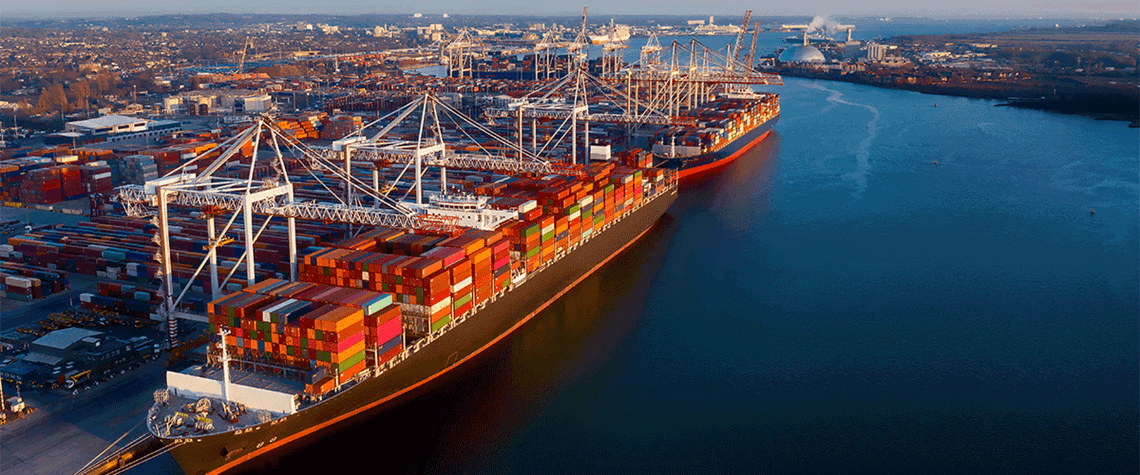

The UK could impose a carbon tax on imports from the middle of this decade to tackle potential “carbon leakage” as its domestic decarbonisation efforts gather pace, the government says in its latest energy strategy update. The government has launched a consultation on the potential deployment of various measures, including an import tax in the form of the Carbon Border Adjustment Mechanism (Cbam) and the introduction of product standards requirements. “As we increase our efforts to decarbonise domestically, we must ensure production, and the associated greenhouse gas emissions, do not shift to other countries with lower carbon pricing and climate regulation,” the government says in a strateg

Also in this section

9 January 2026

A shift in perspective is needed on the carbon challenge, the success of which will determine the speed and extent of emissions cuts and how industries adapt to the new environment

2 January 2026

This year may be a defining one for carbon capture, utilisation and storage in the US, despite the institutional uncertainty

23 December 2025

Legislative reform in Germany sets the stage for commercial carbon capture and transport at a national level, while the UK has already seen financial close on major CCS clusters

15 December 2025

Net zero is not the problem for the UK’s power system. The real issue is with an outdated market design in desperate need of modernisation