Ineos secures €3.5bn for green cracker project

Ethane cracker plant at port of Antwerp to use hydrogen generated as a byproduct of its own ethylene production

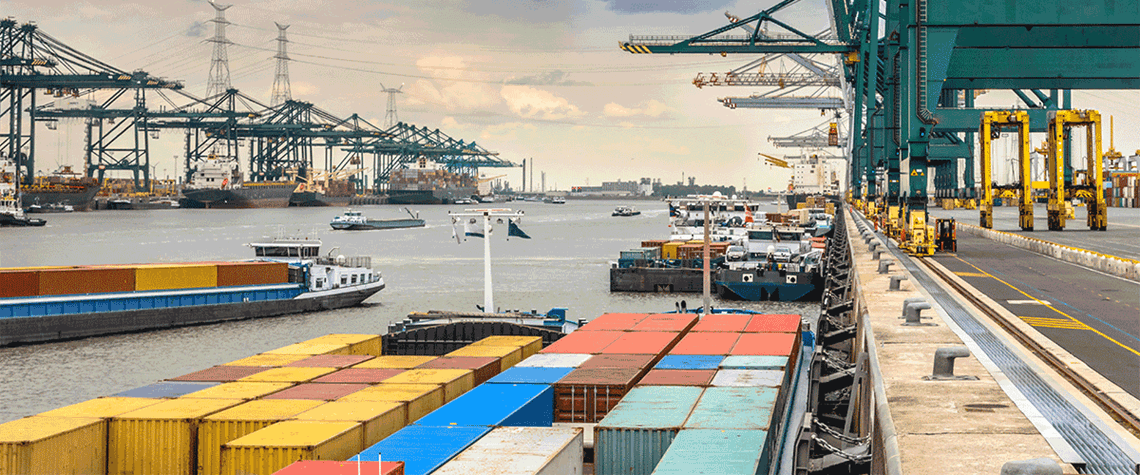

Chemicals company Ineos has secured loans totalling €3.5bn ($3.7bn) to help fund the construction and operation of its ‘Project One’ low-carbon ethane cracker at the port of Antwerp in Belgium. In total, 21 commercial banks, including ABN Amro, Barclays, ING and Deutsche Bank have lent to the project, which Ineos says will be Europe’s most sustainable cracker and the continent’s largest chemical sector investment for a generation. Ineos has put the total cost at €4bn. Construction of the project started in December, and commissioning is scheduled for 2026. “Project One is a game-changer for Europe,” says Jason Meers, CFO of the project. “It will bring new opportunities to the chemical cluste

Also in this section

25 February 2026

Low-carbon hydrogen and ammonia development is advancing much more slowly and unevenly than once expected, with high costs and policy uncertainty thinning investment. Meanwhile, surging energy demand is reinforcing the role of natural gas and LNG as the backbone of the global energy system, panellists at LNG2026 said

18 February 2026

Norwegian energy company has dropped a major hydrogen project and paused its CCS expansion plans as demand fails to materialise

4 February 2026

Europe’s largest electrolyser manufacturers are losing patience with policymakers as sluggish growth in the green hydrogen sector undermines their decision to expand production capacity

2 February 2026

As a fertiliser feedstock, it is indispensable, but ammonia’s potential as a carbon-free energy carrier is also making it central to global decarbonisation strategies