Too big to start?

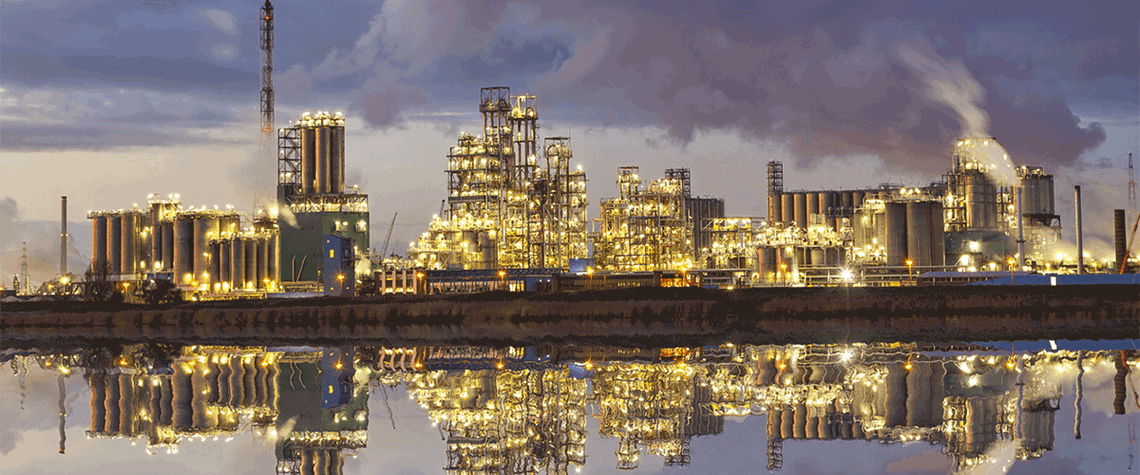

Hydrogen projects need to be developed at large scale to secure offtake from end-users wary of security of supply—but this throws up hurdles for financing, argues the EBRD

Over the past year, a wave of hydrogen projects has been announced in the wake of growing government support and pressure on industrial companies to decarbonise their operations. But the sheer scale of hydrogen production needed to secure offtake deals presents significant risks to those financing projects, warns Cristian Carraretto, head of sustainable business and infrastructure, energy transition, at the European Bank of Reconstruction and Development (EBRD), in an interview with Hydrogen Economist. “The challenge is, the nature of this market calls for large scale. Producers need to have big pockets and a big appetite for risk as a first, early mover,” Carraretto says. Offtakers require

Also in this section

6 August 2025

The US state of Kansas is emerging as a hotspot for a growing number of gold hydrogen prospectors

6 August 2025

EU industry and politicians are pushing back against the bloc’s green agenda. Meanwhile, Brussels’ transatlantic trade deal with Washington could consolidate US energy dominance

25 July 2025

Oil major cites strategy reset as it walks away from Australian Renewable Energy Hub, leaving partner InterContinental Energy to lead one of world’s largest green hydrogen projects

23 July 2025

Electrolysis seen as most leakage-prone production pathway as study warns of sharp increase through 2030 and beyond