As the world begins to grapple with the energy transition and what it will mean to move away from fossil fuels, there is one place that is already ahead of the game. Latin America has historically been an area that has relied on many resources aside from hydrocarbons for things such as power generation and mobility.

Due to its enormous size, relatively low and concentrated population and geographic features, the region has been a net exporter of hydrocarbons, and raw commodities in general, from the start. There is no doubt that fossil fuels will still be important for Latin America, particularly natural gas as a flex fuel of sorts, but no region has a longer history with, or is better prepared to embrace, renewable energy.

The definition of the term “energy transition” is still evolving and from a semantics standpoint is probably somewhat misleading. Humans have been transitioning through different sources of energy since the advent of fire and will always continue to do so. What is generally meant by the term is a pivot away from using hydrocarbons.

But much like humans still use wood to produce energy even today, hydrocarbons will, in some form or fashion, likely remain in use for the foreseeable future. What is forecasted is that their importance, both in terms of oil and natural gas, will lessen as the supply of wind, solar and other forms of renewable resources is able to erode the demand for hydrocarbons.

It’s important to note that this displacement of oil and natural gas isn’t something that will occur overnight or in a vacuum. As it stands today, the world needs around 100m b/d of crude oil to sustain the modern version of life. Fast forward to 2050 and the forecast is still robust with regards to demand for oil—the mean case lands at 66m b/d.

So, while peak demand for oil may occur in this decade, the demand tail will be long, and even longer for natural gas. In the period of 2020-22 it was observed that of all the investment in energy globally, 55% went to fossil fuel projects. Until renewable energy projects can become more competitive from an investment standpoint, without having to depend on government subsidisation, hydrocarbons will continue to receive a similar percentage of capital outlay going forward.

With all of that said, when thinking about oil and gas as a transition fuel in Latin America, it’s much more about being a producer and exporter of this resource than it is about being an end user. As mentioned previously, Latin America is a net exporter of oil and is well placed to continue to be so in the medium to long term. In fact, Latin America may have an edge on other oil producing regions going into the 2030s and 2040s because of the unique characteristics of its production.

In the offshore regions of both Brazil and Guyana, oil can be produced at an extremely low breakeven cost. The pre-salt projects and Liza 1 and 2 are below $30/bl in most cases. That same production also has an exceptionally low emissions intensity per barrel produced, in the range of 8-9kg of carbon dioxide per barrel. To put it into context, that’s about half the global average of 18kg of carbon dioxide per barrel. These are both the necessary and sufficient conditions to be a part of the future global supply mix.

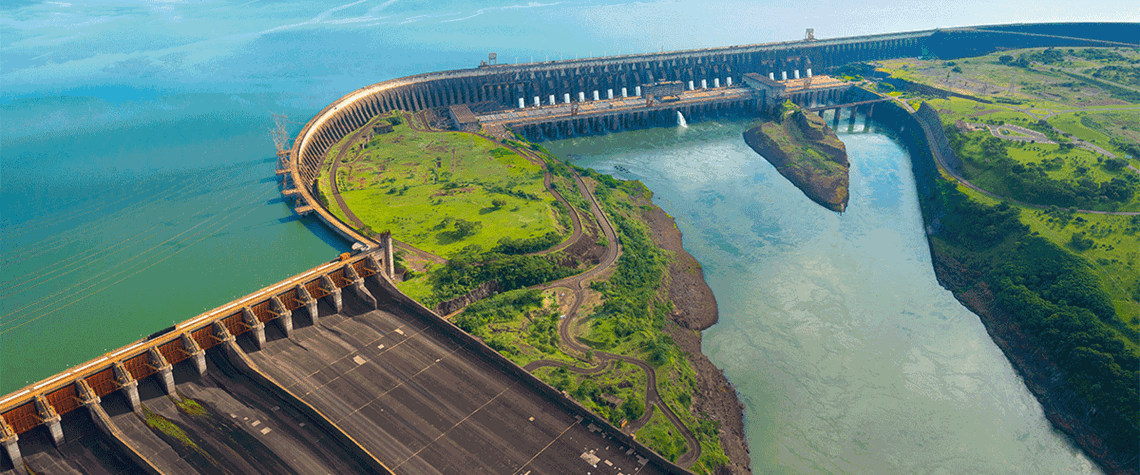

From an end-user perspective oil and gas are maybe less important as a transition fuel in Latin America. Power generation has traditionally been dominated by hydro in a region that has been blessed with an incredible fluvial system. The foresight to install generators into massive public works projects dates back decades and created several “green” grids throughout the region. Latin America also benefits from having a low population density, with around 600m people who live between the Rio Bravo in Mexico and the Straits of Magellan in Argentina.

That small population is, however, highly urbanised, in fact more so than any other region on earth. This unique fact means that power generation can be dispatched in a more concentrated manner. It also means that mobility can be tackled in more creative and innovative ways.

Already in Brazil almost all vehicles can run exclusively on ethanol produced from sugarcane. Mass transit systems are turning to other sources of fuel as well. The city of Bogota has rolled out hydrogen-powered buses as part of its efforts to decarbonise. Although mass adoption of electric vehicles may seem a distant prospect, the region has many other routes to a non-fossil fuel future.

Latin America will continue to be a place of innovation, mostly by way of necessity, when it comes to the energy transition. All of the building blocks for a green future can be found there. Lithium deposits are plentiful and there is no lack of wind or sun across the vast expanses of both South and Central America including Mexico.

Green hydrogen and biofuels production are already gaining strong footholds across several different countries and these sectors can only be expected to grow. While it’s true that diesel and gasoline still play a big role in agriculture, which is arguably the lifeblood of the region, the trend is already moving in the right direction. Hydrocarbons will have their role to play in Latin America as a transition fuel, but more likely as commodities to be sold abroad rather than consumed domestically.

Schreiner Parker is the managing director Latin America at Rystad Energy.

This article was published as part of PE Outlook 2024, which is available for subscribers here. Non-subscribers can purchase a copy of the digital edition here.

Comments