Alaska LNG advances on energy security concerns

The supply shock caused by Russia’s invasion of Ukraine could push the long-delayed liquefaction project across the finish line

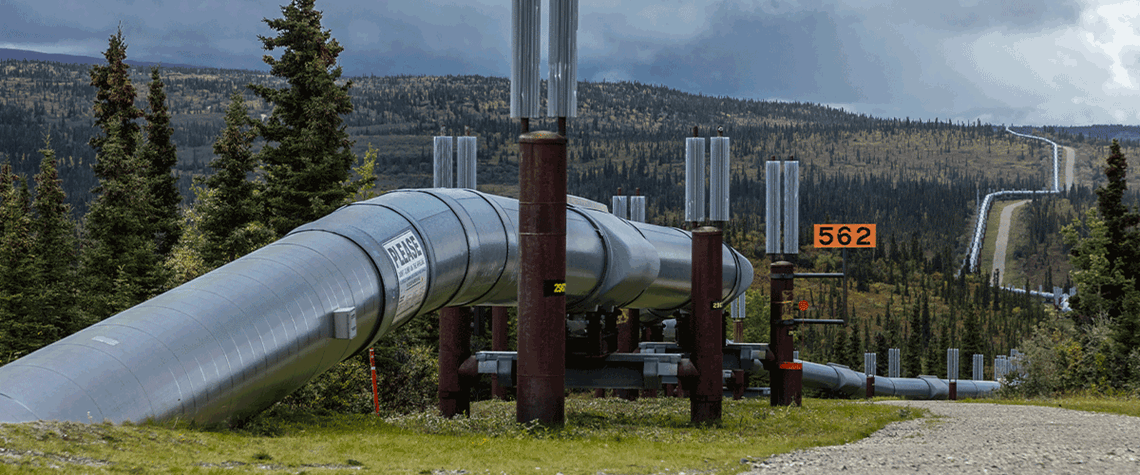

The focus on boosting energy security following Russia’s invasion of Ukraine last February has revived the fortunes of the stalled Alaska LNG development. The liquefaction project—also known as 8-Star—is being developed by state-owned Alaska Gasline Development Corp (AGDC), after a consortium made up of North Slope producers ConocoPhillips, ExxonMobil and BP (which has since sold its Alaskan business to independent Hilcorp Energy) dropped the scheme in 2016, claiming poor economics. AGDC is now confident the project will achieve FID within the next few years, its president, Frank Richards, tells Petroleum Economist. “Russia’s invasion of Ukraine has led to a dramatic increase in interest fro

Also in this section

4 March 2026

The continent’s inventories were already depleted before conflict erupted in the Middle East, causing prices to spike ahead of the crucial summer refilling season

4 March 2026

The US president has repeatedly promised to lower gasoline prices, but this ambition conflicts with his parallel aim to increase drilling and could be upended by his war against Iran

4 March 2026

With the Strait of Hormuz effectively closed following US-Israel strikes and Iran’s retaliatory escalation, Fujairah has become the region’s critical pressure release valve—and is now under serious threat

3 March 2026

The killing of Iran’s Supreme Leader Ayatollah Khamenei in US–Israeli strikes marks the most serious escalation in the region in decades and a bigger potential threat to the oil market than the start of the Russia-Ukraine crisis