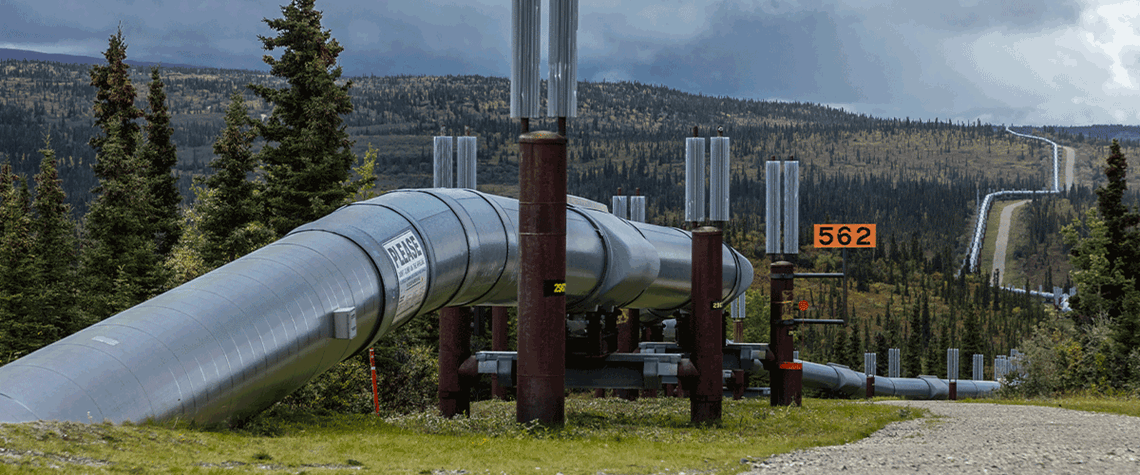

Alaska LNG advances on energy security concerns

The supply shock caused by Russia’s invasion of Ukraine could push the long-delayed liquefaction project across the finish line

The focus on boosting energy security following Russia’s invasion of Ukraine last February has revived the fortunes of the stalled Alaska LNG development. The liquefaction project—also known as 8-Star—is being developed by state-owned Alaska Gasline Development Corp (AGDC), after a consortium made up of North Slope producers ConocoPhillips, ExxonMobil and BP (which has since sold its Alaskan business to independent Hilcorp Energy) dropped the scheme in 2016, claiming poor economics. AGDC is now confident the project will achieve FID within the next few years, its president, Frank Richards, tells Petroleum Economist. “Russia’s invasion of Ukraine has led to a dramatic increase in interest fro

Also in this section

23 July 2025

Gas is unlikely to assume a major role in Albania’s energy mix for years to come, but two priority projects are making headway and helping to establish the sector

22 July 2025

The gas-hungry sector is set for rapid growth, and oil majors and some of the world’s largest LNG firms are investing in ammonia production and export facilities, though much depends on regulatory support

22 July 2025

Next year’s WPC Energy Congress taking place in April in Riyadh, Saudi Arabia will continue to promote the role of women in the energy sector, with a number of events focusing on the issue.

22 July 2025

Pedro Miras is the serving President of WPC Energy for the current cycle which will culminate with the 25th WPC Energy Congress in Riyadh, Saudi Arabia in April 2026. He has over 30 years of experience in the energy sector, including stints with Repsol and the IEA. Here he talks to Petroleum Economist about the challenges and opportunities the global energy sector currently faces.