BP and Adnoc bid a further twist in Leviathan tale

Could the NOC/major play for Newmed stake precipitate further changes to the Israeli field’s expansion roadmap?

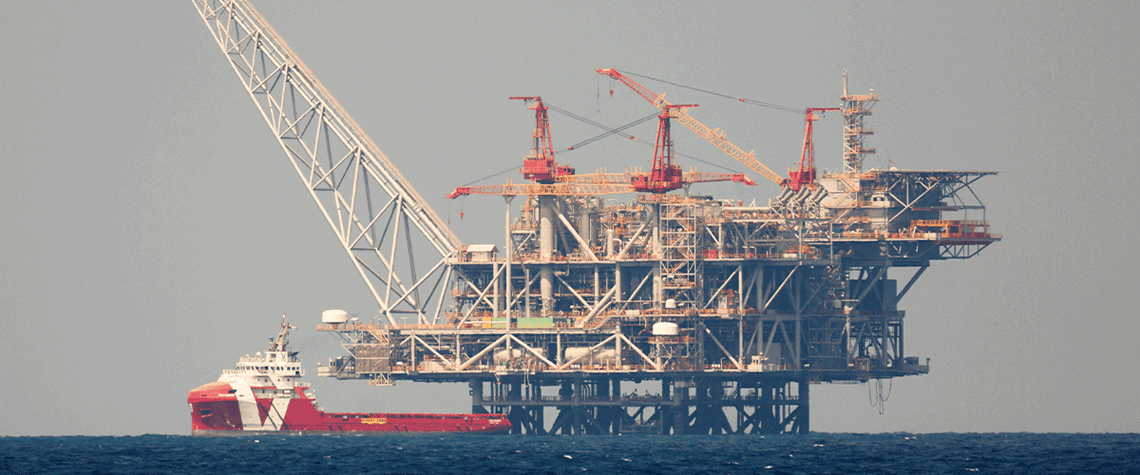

Israeli independent Newmed Energy’s late-February announcement of an almost $100mn investment by partners in the Leviathan gas field in a pre-Feed expansion study seemed a conclusion of sorts to its development story. But a late March swoop by Abu Dhabi’s state-owned Adnoc and BP for a 50pc interest in Newmed—the field’s largest shareholder—might muddy the waters again. The NOC and major have proposed taking listed Newmed private by hoovering up its 45pc free float and taking a further 5pc ownership from current parent Delek. The two firms will “form a new joint venture that will be focused on gas development in international areas of mutual interest, including the East Mediterranean”. There

Also in this section

27 February 2026

LNG would serve as a backup supply source as domestic gas declines and the country’s energy system comes under stress during periods of low hydropower output and high energy demand

27 February 2026

The assumption that oil markets will re-route and work around sanctions is being tested, and it is the physical infrastructure that is acting as the constraint

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

27 February 2026

The deepwater sector must be brave by fast-tracking projects and making progress to seize huge offshore opportunities and not become bogged down by capacity constraints and consolidation