China’s gas goals face unconventional hurdles

Beijing’s strong emphasis on domestic production growth will require heavier investment from the country’s NOCs, as remaining reserves become harder to exploit

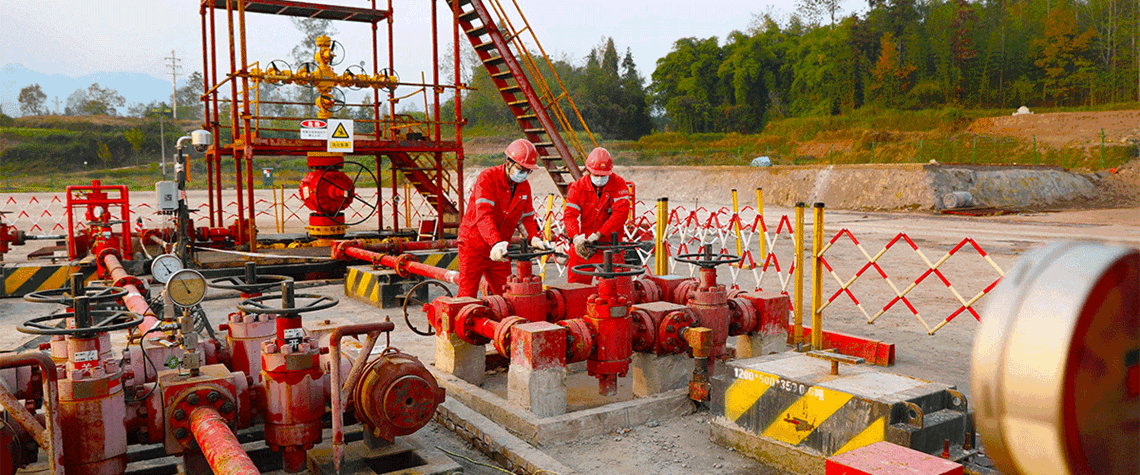

China’s domestic gas output will continue to grow for the rest of this decade, as the country’s energy giants eke out greater production at prolific legacy fields. But later gains could become harder to come by, as upstream development will eventually have to shift to complex frontier plays, both onshore and offshore, that are more challenging to exploit. China has managed to increase gas output by more than 10bcm/yr for the past six years, a streak the central government is keen to continue. PetroChina, Sinopec and CNOOC—which together accounted for 83% of gas produced in China in the first nine months of this year—have persistently sustained or increased domestic investment, under governme

Also in this section

25 July 2025

Mozambique’s insurgency continues, but the security situation near the LNG site has significantly improved, with TotalEnergies aiming to lift its force majeure within months

25 July 2025

There is a bifurcation in the global oil market as China’s stockpiling contrasts with reduced inventories elsewhere

24 July 2025

The reaction to proposed sanctions on Russian oil buyers has been muted, suggesting trader fatigue with Trump’s frequent bold and erratic threats

24 July 2025

Trump energy policies and changing consumer trends to upend oil supply and demand