Global LNG analysis report 2023 – Part 4

The fourth and final part of this deep-dive analysis looks at LNG projects planned or underway across the Americas

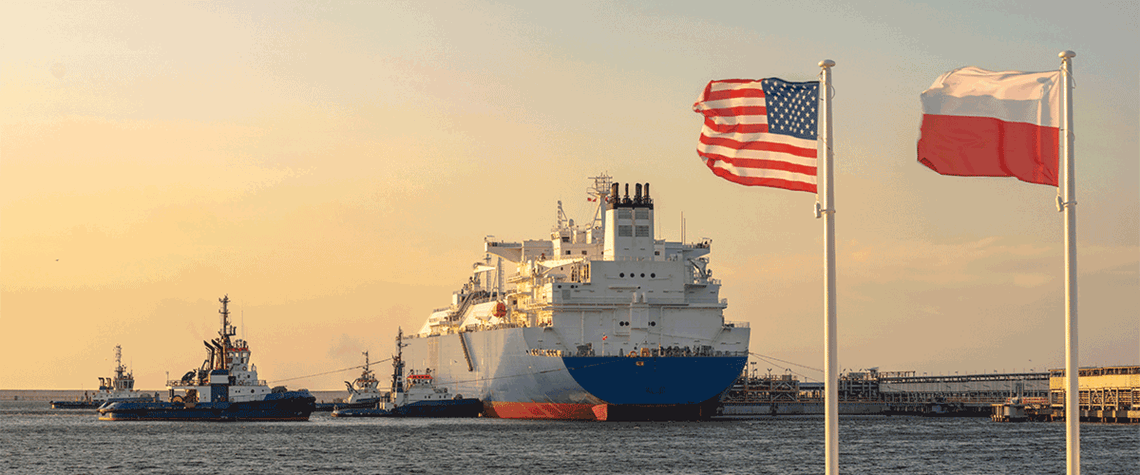

Global gas demand is being by short-term and long-term factors including the energy transition and the war in Ukraine. The first three parts of this report covered liquefaction and regasification projects in Africa, the Middle East, Asia and Europe. This fourth instalment examines North and Central/South Americas. Most notably within the region, the US has transformed itself from being an importer of gas around a decade ago to being the largest supplier of LNG in the world. North of the border, Canada has had less success in progressing its projects, with only a small number likely to push ahead to completion. Meanwhile, in Central and South America, Mexico remains the most significant count

Also in this section

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true

25 February 2026

The surge in demand for fuel and petrochemical products in Asia has led to significant expansion in refining and petrochemicals capacities, with India and China leading the way