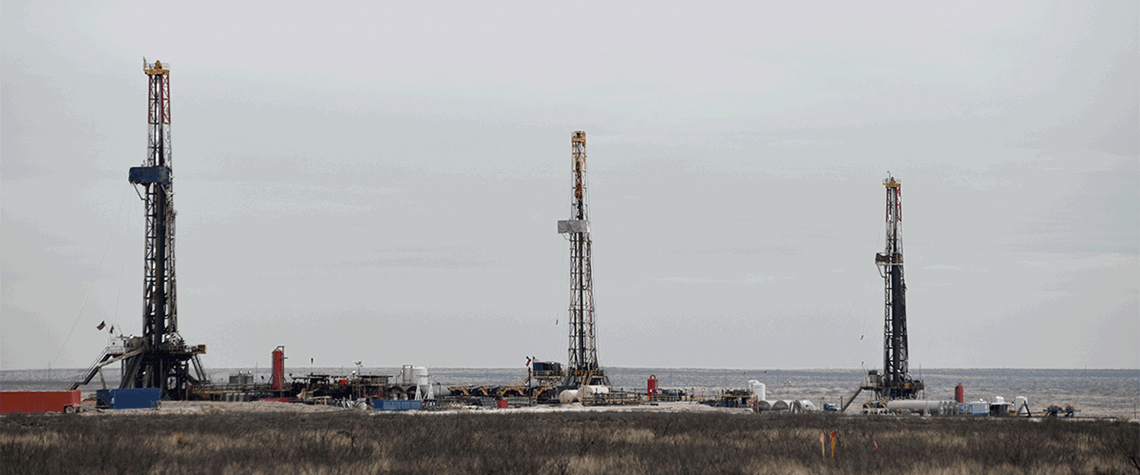

Shale drillers try to stay patient amid gas price slump

Producers resist urge to respond too quickly to gas price trends

US shale drillers are keeping their plans unchanged for now as they ride the peaks and troughs of gas price volatility. Prices spiked last year in the wake of Russia’s invasion of Ukraine but have since dropped back to pre-war levels, and analysts question whether the industry has learned lessons from the past—when quick responses to price changes have left producers playing catch-up. Certainly, the industry remains sensitive to price signals, and further fluctuations will shape how gas drilling plays out over the remainder of 2023 and beyond. Various other factors will also have an impact on behaviour, however, including how companies are structured and what their asset mixes look like. Whi

Also in this section

7 August 2025

Without US backing, the EU’s newest sanctions package against Russia—though not painless—is unlikely to have a significant impact on the country’s oil and gas revenues or its broader economy

6 August 2025

Diesel market disruptions have propelled crude prices above $100/bl twice in this century, and now oil teeters on the brink of another crude quality crisis

5 August 2025

After failed attempts to find a buyer for its stake in Russia’s largest oil producer, BP may be able to avoid the harsh treatment meted out to ExxonMobil and Shell when they exited—and could even restart operations if geopolitical conditions improve

1 August 2025

A number of companies have filed arbitration claims against Gazprom over non-deliveries of contracted gas or other matters—and won. The next step is to collect the award, but this is no easy task