Petronet LNG says price key despite Qatar ties

Huge QatarEnergy deal lays down marker in India’s gas shift, but CEO stresses price still biggest driver as Petronet LNG looks at further buying opportunities

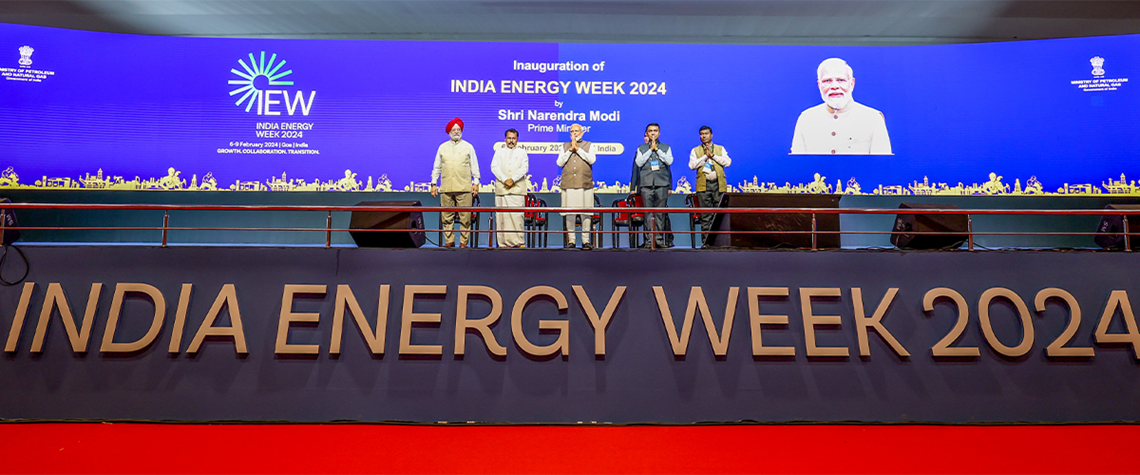

Akshay Kumar Singh, CEO of India’s Petronet LNG, gave a clear insight into his company’s gas importing strategy at India Energy Week (IEW) in February: “Wherever we get the better deal, we can go,” he told Petroleum Economist. Petronet signed a deal at IEW with QatarEnergy to supply 7.5mt/yr on a delivered ex-ship basis from 2028 to 2048 amid a strong message that gas will play a huge role in both India’s energy security strategy and its energy transition plans. The SPA extension between QatarEnergy and Petronet covers a total of 150mt over 20 years, making it the largest such deal ever signed. It will help India meet its target of increasing the share of gas in its energy mix to 15% by 2030

Also in this section

3 March 2026

The killing of Iran’s Supreme Leader Ayatollah Khamenei in US–Israeli strikes marks the most serious escalation in the region in decades and a bigger potential threat to the oil market than the start of the Russia-Ukraine crisis

2 March 2026

A potential blockade of the Strait of Hormuz following the escalating US-Iran conflict risks disrupting Qatari LNG exports that underpin global gas markets, exposing Asia and other markets to sharp price spikes, cargo shortages and renewed reliance on dirtier fuels

2 March 2026

The South Asian consumer’s next move could tighten the Middle East oil market overnight

2 March 2026

Canadian independent’s evolving portfolio in Trinidad and Tobago gives it access to the Atlantic LNG market and a close-up view of developments in neighbouring Venezuela