Energean takes a new approach at Karish

The East Mediterranean producer goes for a novel and nimble concept at Karish

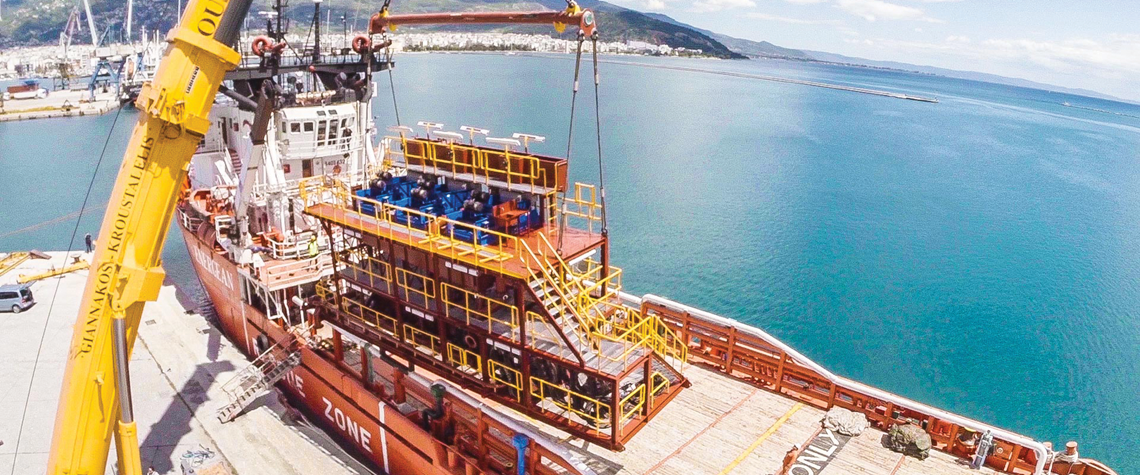

London and Tel-Aviv-listed independent Energean took FID at its Karish-Tanin field offshore Israel in March, less than 20 months after project acquisition. It credits an innovative procurement process for the shortened timeframe. Energean dispensed with concept selection and pre-feasibility studies. Instead it selected a floating production, storage and offloading (FPSO) solution, both for maximising recovery by reducing pressure on the wells through proximate infrastructure and in siting most of the technology 100km away from Israel's infrastructure-averse shore dwellers. Based on Energean's size at that time, it wanted a strong technical partner but, rather than a lengthy tendering process

Also in this section

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true