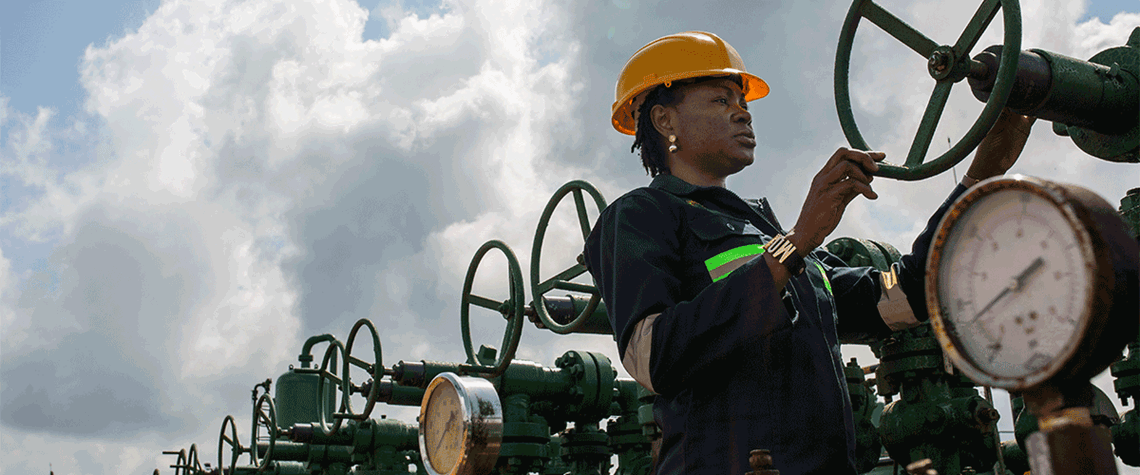

Letter on Africa: Nigeria's oil and gas industry needs more than new faces

IOCs are reducing their footprint in what was until recently Africa's largest oil producer despite key oil legislation being passed

Nigeria’s oil and gas industry needs a reset. Years of underinvestment, crude theft and sabotage have weighed down output. Oil production hit a low of 1.1mn bl/d in mid-2022, almost half that seen in January 2020. Although output in December 2022 was up to 1.4mn bl/d of crude and condensate, the medium-to-long-term outlook is not encouraging, and the 2mn bl/d it reached just a few years ago seems a distant memory. With presidential elections imminent, can a change of guard breathe much-needed life into the country’s ailing industry? The current administration was able to oversee the passage of the long-awaited Petroleum Industry Act (PIA), but subsequent implementation has been slow. And cru

Also in this section

27 February 2026

The assumption that oil markets will re-route and work around sanctions is being tested, and it is the physical infrastructure that is acting as the constraint

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America