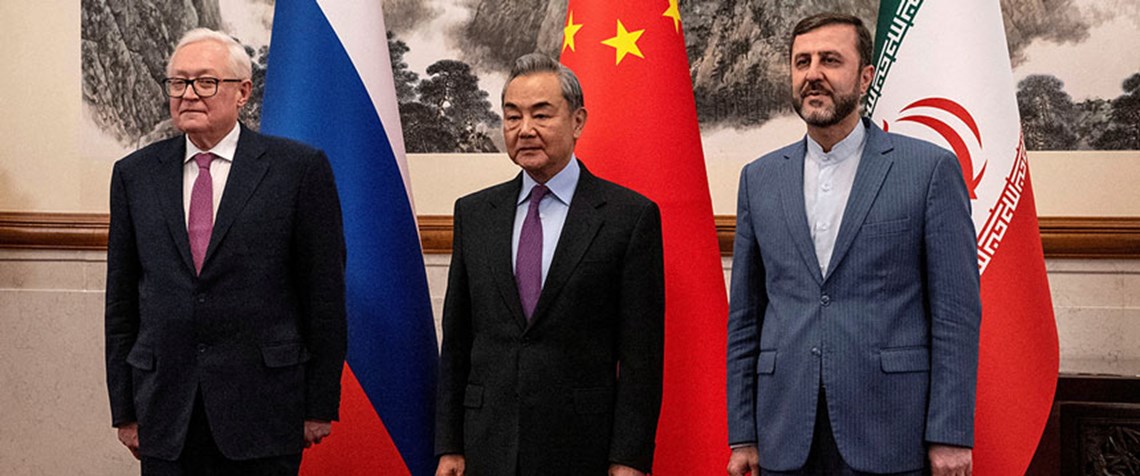

Letter from Iran: High-stakes nuclear diplomacy

Iran’s oil is caught in the crosshairs of support from China and Russia and US maximum pressure, with options becoming more and more limited

Iran's nuclear talks have once again made headlines as US President Donald Trump has threatened Tehran with a deadline—either reach an agreement or face military action. His remarks have been met with strong reactions from Iranian officials, who have emphasised they will not negotiate under pressure. Ayatollah Khamenei, Iran's supreme leader, has rejected talks with the US, deeming it a "bullying" government. He also described negotiations with the US as unwise and dishonourable, expressions that make any form of negotiation particularly challenging for Iran’s moderate government. It will be China that decides whether to preserve Iran and defend Chinese companies dealing with the Middl

Also in this section

27 February 2026

The assumption that oil markets will re-route and work around sanctions is being tested, and it is the physical infrastructure that is acting as the constraint

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America