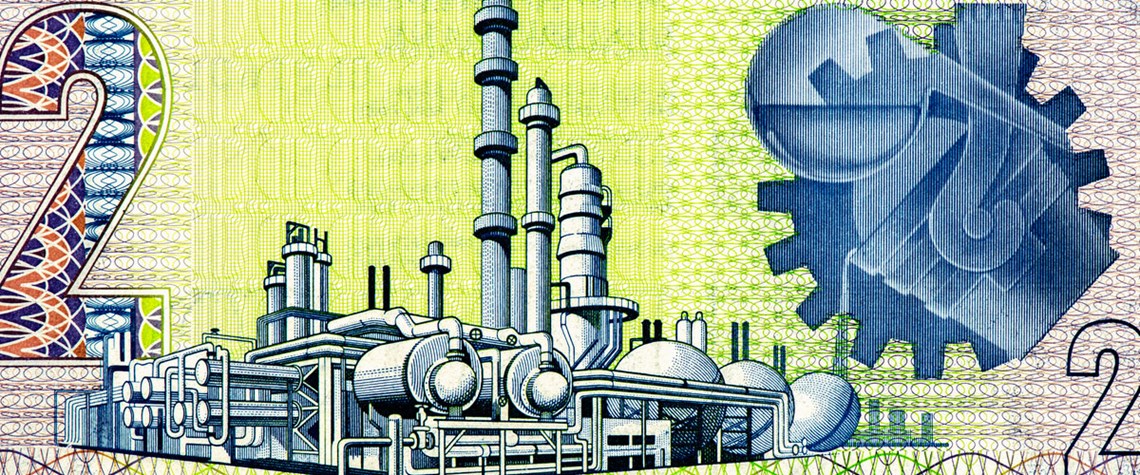

Africa bucks global refining trend

Despite oil companies the world over mothballing old refineries and putting new projects on hold, there has been a recent bustle of activity in sub-Saharan Africa

Three countries—Congo, Angola and Nigeria—have seen the bulk of the activity. Congo (Brazzavile) is pressing ahead with a $600mn integrated export refinery and petrochemical complex, while Angola is building three new facilities and tripling gasoline production at its Luanda refinery. The Dangote Group expects the first phase of its 650,000bl/d Nigerian refinery—the continent’s largest—to be completed in January. Tendering is also under way for the long-awaited rehabilitation of Nigeria’s four state-owned facilities. A scattering of smaller, modular refineries are also in the works. “There has been a flurry of small African refining projects just as shutdown announcements of European and Ame

Also in this section

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true