Middle East refiners primed for growth

Capacity additions set to take advantage of disruption to Russian diesel

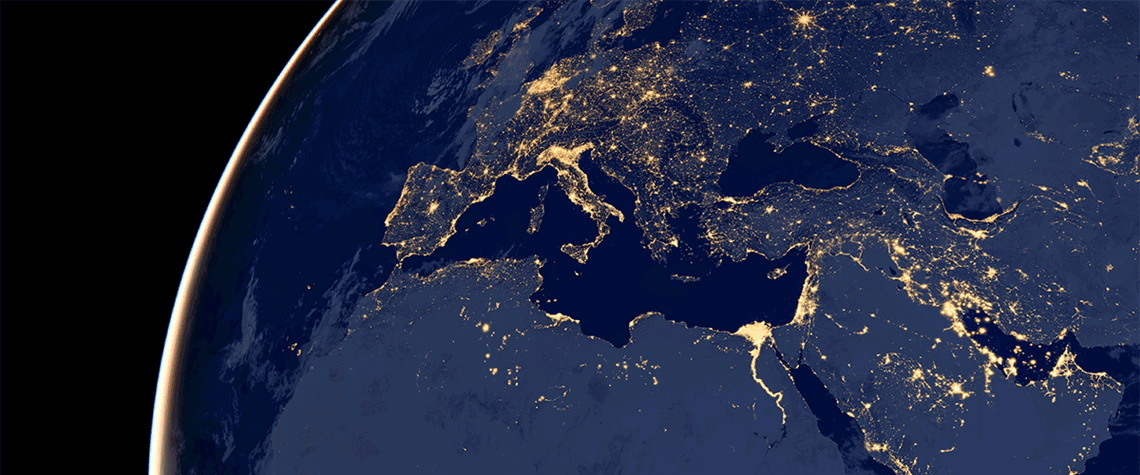

A combination of new refineries and the expansion of existing facilities means the Middle East is well positioned to capitalise on the potential drop-off in diesel and fuel supply from Russia and the expected rise in global oil demand. While the Middle East is often viewed as an upstream powerhouse—being home to six Opec nations—it is starting to also become known as a major downstream hub too—with more than 50 refineries. “New grassroots refineries and expansion projects across the Middle East in 2023 and 2024 are expected to push the region’s total refinery capacity (crude distillation and condensate splitter) from 9.7mn bl/d in 2022 to 10.5mn bl/d in 2023 and 11.1mn bl/d in 2024,” says Im

Also in this section

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true