Middle East refiners primed for growth

Capacity additions set to take advantage of disruption to Russian diesel

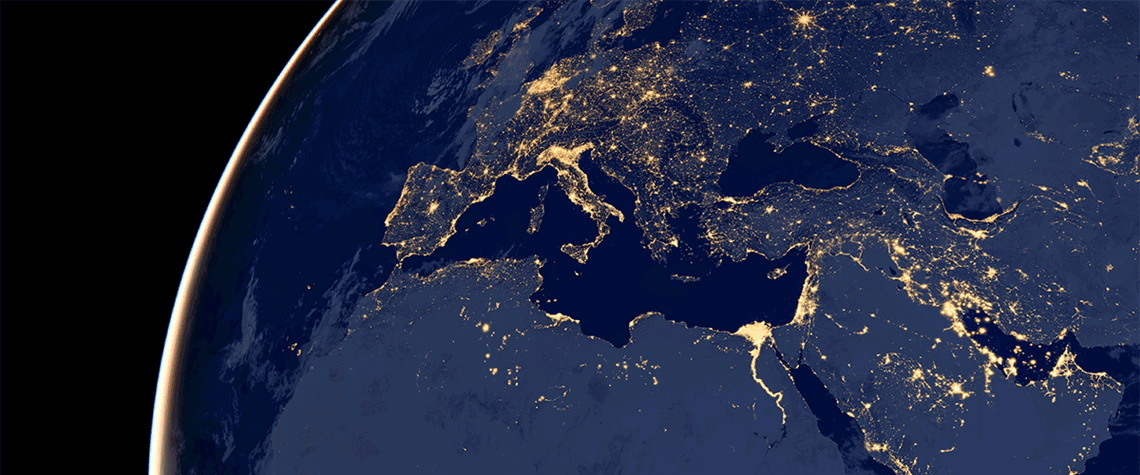

A combination of new refineries and the expansion of existing facilities means the Middle East is well positioned to capitalise on the potential drop-off in diesel and fuel supply from Russia and the expected rise in global oil demand. While the Middle East is often viewed as an upstream powerhouse—being home to six Opec nations—it is starting to also become known as a major downstream hub too—with more than 50 refineries. “New grassroots refineries and expansion projects across the Middle East in 2023 and 2024 are expected to push the region’s total refinery capacity (crude distillation and condensate splitter) from 9.7mn bl/d in 2022 to 10.5mn bl/d in 2023 and 11.1mn bl/d in 2024,” says Im

Also in this section

22 July 2025

The gas-hungry sector is set for rapid growth, and oil majors and some of the world’s largest LNG firms are investing in ammonia production and export facilities, though much depends on regulatory support

22 July 2025

Next year’s WPC Energy Congress taking place in April in Riyadh, Saudi Arabia will continue to promote the role of women in the energy sector, with a number of events focusing on the issue.

22 July 2025

Pedro Miras is the serving President of WPC Energy for the current cycle which will culminate with the 25th WPC Energy Congress in Riyadh, Saudi Arabia in April 2026. He has over 30 years of experience in the energy sector, including stints with Repsol and the IEA. Here he talks to Petroleum Economist about the challenges and opportunities the global energy sector currently faces.

17 July 2025

US downstream sector in key state feels the pain of high costs, an environmental squeeze and the effects of broader market trends