South Korea doubles down on Saudi crude

Seoul dabbles with Russian and US crude but Middle East remains primary source

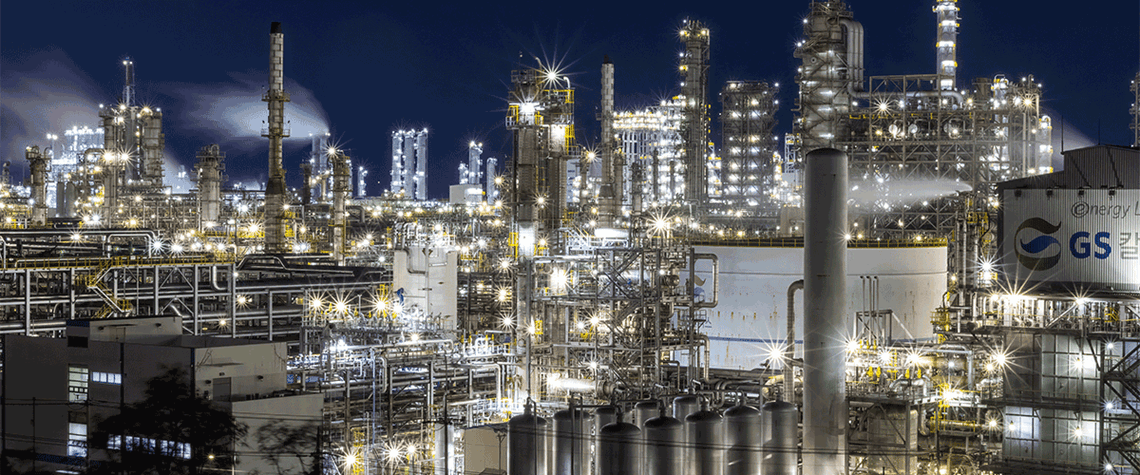

Relations between South Korea and Saudi Arabia have continued to strengthen, and this is clearly reflected in the record crude flows from the Opec behemoth to the Asian economic powerhouse. Back in November 2022, Seoul and Riyadh pledged stronger ties on energy, defence and construction, as the Saudis signed $30bn of investment agreements with South Korean firms. Meanwhile, Saudi Arabia’s key oil grades have become a bigger part of the Korean diet despite the perceived importance of diversification and the lure of cheap Russian barrels that neighbours such as China and India have been snapping up. 41pc – Saudi portion of April’s imports Saudi crude accounted for 1mn bl/d, or 41pc,

Also in this section

4 March 2026

The continent’s inventories were already depleted before conflict erupted in the Middle East, causing prices to spike ahead of the crucial summer refilling season

4 March 2026

The US president has repeatedly promised to lower gasoline prices, but this ambition conflicts with his parallel aim to increase drilling and could be upended by his war against Iran

4 March 2026

With the Strait of Hormuz effectively closed following US-Israel strikes and Iran’s retaliatory escalation, Fujairah has become the region’s critical pressure release valve—and is now under serious threat

3 March 2026

The killing of Iran’s Supreme Leader Ayatollah Khamenei in US–Israeli strikes marks the most serious escalation in the region in decades and a bigger potential threat to the oil market than the start of the Russia-Ukraine crisis