Permian output growth stutters

Sluggish production increases could trigger new wave of bankruptcies among operating minnows

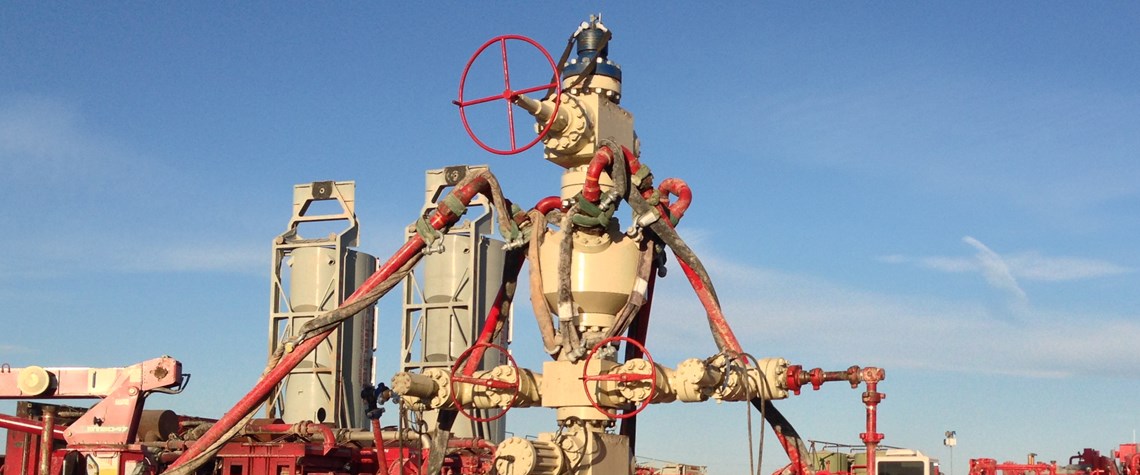

The Permian shale patch is starting to display signs of moving into a production plateau phase, after years of rampant growth which upended the global oil market and transformed the US into a major energy supplier. Production will unquestionably still continue to climb in 2020—the EIA predicts US output will reach 13.3mn bl/d, up from 12.2mn bl/d in 2019—with incremental volumes primarily from the Texan shale patch. But, while overall Permian production may still be on the up, albeit at a far more gradual trajectory than previous years, a slowing rig count, less than-buoyant oil price and lack of offtake gas capacity could further threaten the business model of many of the play’s smaller ind

Also in this section

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true

25 February 2026

The surge in demand for fuel and petrochemical products in Asia has led to significant expansion in refining and petrochemicals capacities, with India and China leading the way