Consolidation heats up for maturing US shale

Growth might not be on the table, but operators are eyeing opportunities to add quality acreage

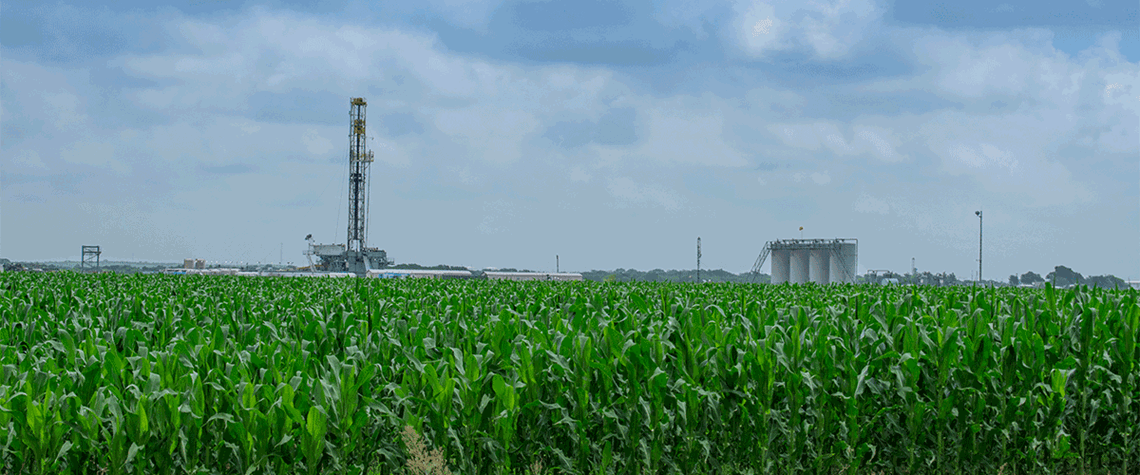

Lack of midstream capacity and dismal upstream growth prospects for 2023 are proving no barrier to M&A activity for maturing US shale basins. Over the past quarter, both the Eagle Ford and Appalachia recorded bumper deals that showcase the perceived long-term potential among operators. In the Eagle Ford, US independent Devon Energy snapped up Texas-focused Validus Energy for $1.8bn last year. The deal doubled the firm’s production base in the basin and increased exposure and access to Gulf Coast pricing. In July, the operator also added a bolt-on acquisition in the Williston basin but stressed there was not likely to be further spending in the immediate future. Other operators soon fo

Also in this section

24 July 2025

The reaction to proposed sanctions on Russian oil buyers has been muted, suggesting trader fatigue with Trump’s frequent bold and erratic threats

24 July 2025

Trump energy policies and changing consumer trends to upend oil supply and demand

24 July 2025

Despite significant crude projections over the next five years, Latin America’s largest economy could be forced to start importing unless action is taken

23 July 2025

The country’s energy minister explains in an exclusive interview how the country is taking a pragmatic and far-sighted approach to energy security and why he has great confidence in its oil sector