More to come in Thailand for Valeura

The Canadian indie is already undergoing rapid growth and is looking for further opportunities in the Southeast Asian country

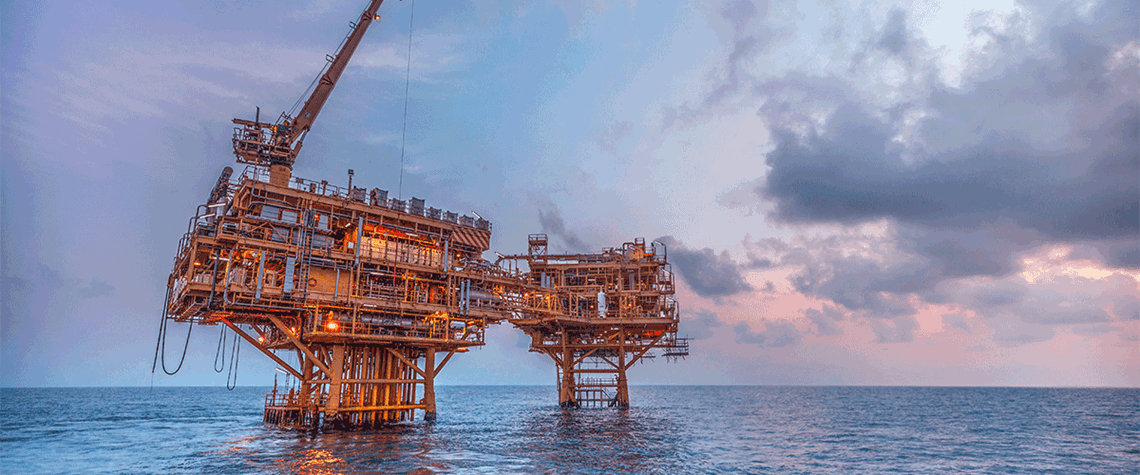

Calgary-based Valeura recently signed a “transformative” SPA with Abu Dhabi’s Mubadala for the state-owned investor’s entire upstream oil portfolio in Thailand. The Canadian independent expects the deal to close this quarter, CEO Sean Guest tells Petroleum Economist. At the time of the deal, the assets’ production totalled “approximately 21,000bl/d from three separate fields”, comprising Jasmine, Manora and Nong Yao, which are in the “mid-to-late” periods of their operational lifespans, explains Guest. “There is still growth potential within this portfolio,” he continues. “While we expect a slow decline in production from the large fields like Jasmine and Manora, we still have the Nong Yao f

Also in this section

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true