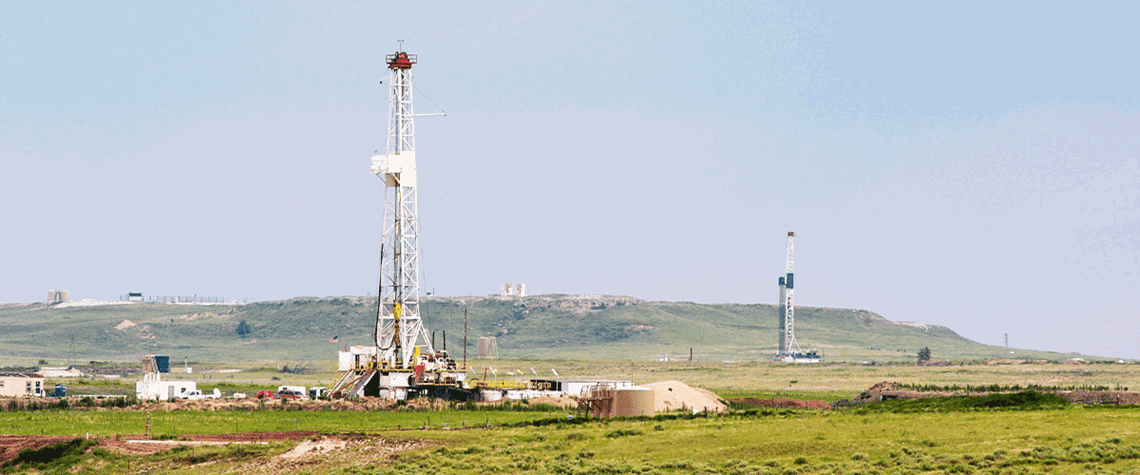

US oil and gas output on the rise

Surging crude prices prompted increased drilling activity last year, but debt and financing issues constrained growth

Drilling activity in the US increased by 51.3pc on an average yearly basis in 2022, driving crude production up to 11.9mn bl/d and marking a 6.4pc increase compared with the 11.2mn bl/d averaged in 2021. The increased output was augmented by US companies completing a large backlog of drilled-but-uncompleted (Duc) wells in two major oil shale basins. WTI started 2022 at $83.22/bl and climbed steadily throughout the year, despite rising interest rates, fears of economic recession and restricted Russian supply caused by the war in Ukraine. Crude prices hit a 15-year high in June 2022, at $114.84/bl, before falling back down and ending the year at $76.44/bl. The surge in commodity prices caused

Also in this section

23 July 2025

Gas is unlikely to assume a major role in Albania’s energy mix for years to come, but two priority projects are making headway and helping to establish the sector

22 July 2025

The gas-hungry sector is set for rapid growth, and oil majors and some of the world’s largest LNG firms are investing in ammonia production and export facilities, though much depends on regulatory support

22 July 2025

Next year’s WPC Energy Congress taking place in April in Riyadh, Saudi Arabia will continue to promote the role of women in the energy sector, with a number of events focusing on the issue.

22 July 2025

Pedro Miras is the serving President of WPC Energy for the current cycle which will culminate with the 25th WPC Energy Congress in Riyadh, Saudi Arabia in April 2026. He has over 30 years of experience in the energy sector, including stints with Repsol and the IEA. Here he talks to Petroleum Economist about the challenges and opportunities the global energy sector currently faces.