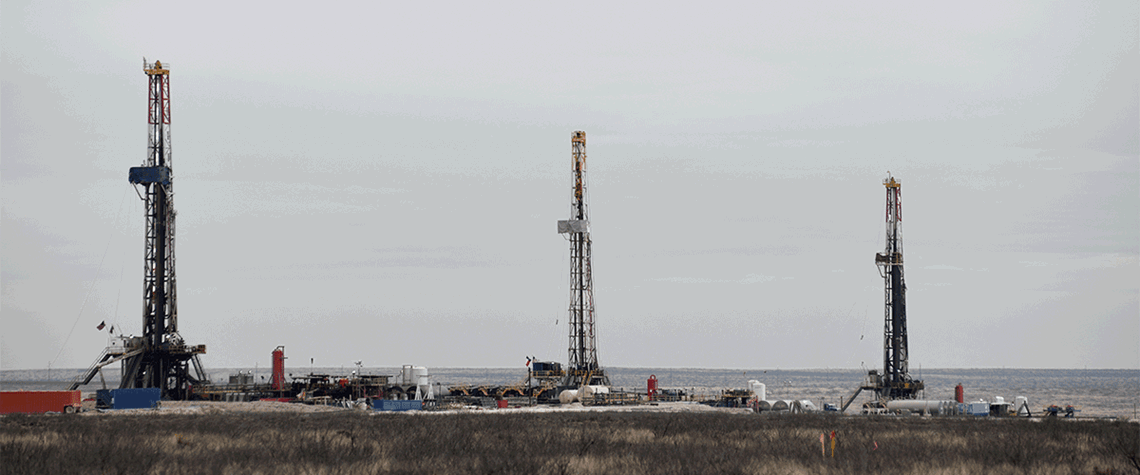

US shale starts 2023 in ‘realistic’ mood

First-quarter shale results show ongoing restraint amid signs of cost deflation

The first-quarter earnings season has highlighted signs of improved capital spending in the US, while certain tight oil producers have flagged up signs of cost deflation in oilfield services and equipment. Meanwhile, lower gas prices have caused producers in gas-rich basins to scale back operations, while oil prices—which have also declined since 2022—remain strong enough to support activity. Consultancy Wood Mackenzie notes in a report rounding up results among 42 US independents that WTI prices averaged $76/bl in the first quarter of 2023. This is “much closer to a ‘mid-cycle’ level than last year’s average of $96/bl”, it says. “Mid-cycle is not a hard and fast number, but that is generall

Also in this section

24 July 2025

The reaction to proposed sanctions on Russian oil buyers has been muted, suggesting trader fatigue with Trump’s frequent bold and erratic threats

24 July 2025

Trump energy policies and changing consumer trends to upend oil supply and demand

24 July 2025

Despite significant crude projections over the next five years, Latin America’s largest economy could be forced to start importing unless action is taken

23 July 2025

The country’s energy minister explains in an exclusive interview how the country is taking a pragmatic and far-sighted approach to energy security and why he has great confidence in its oil sector