Surging battery mineral prices threaten EV growth

EV sales growth remains robust in 2022, but rising mineral prices and supply chain dislocations present near-term challenges, says IEA

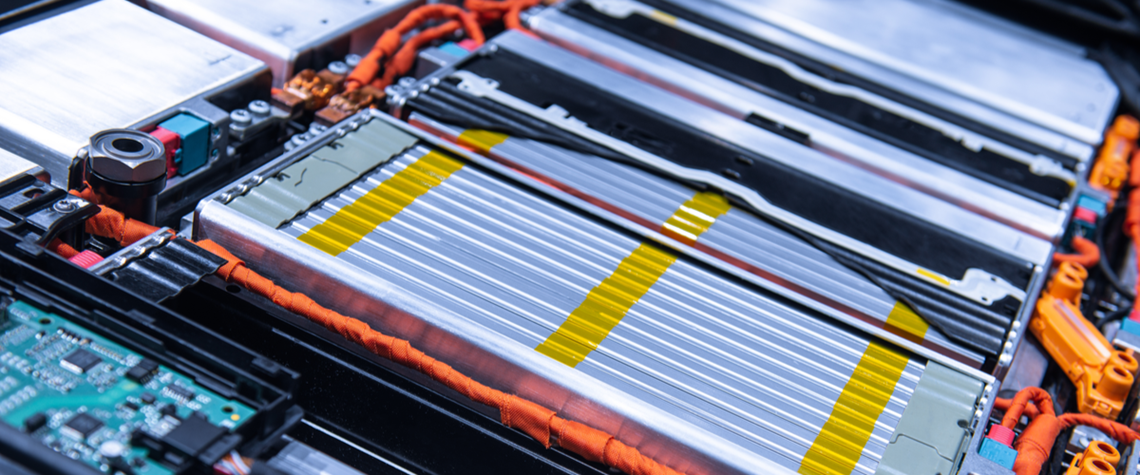

Sales of electric vehicles (EV) remain strong so far this year, but the market faces significant near-term headwinds in the form of soaring mineral prices and supply chain disruptions, according to the IEA. Prices for lithium, a crucial mineral used in car batteries, were over seven times higher in May 2022 than at the start of 2021, and prices for cobalt and nickel also rose, the IEA notes. All else being equal, the cost of battery packs could increase by 15pc if these prices stay around current levels—reversing several years of declines. Russia’s invasion of Ukraine has created further pressures, since Russia supplies 20pc of global battery-grade nickel. Continued Covid-19 lockdowns in som

Also in this section

22 July 2025

Sinopec hosts launch of global sharing platform as Beijing looks to draw on international investors and expertise

22 July 2025

Africa’s most populous nation puts cap-and-trade and voluntary markets at the centre of its emerging strategy to achieve net zero by 2060

17 July 2025

Oil and gas companies will face penalties if they fail to reach the EU’s binding CO₂ injection targets for 2030, but they could also risk building underused and unprofitable CCS infrastructure

9 July 2025

Latin American country plans a cap-and-trade system and supports the scale-up of CCS as it prepares to host COP30