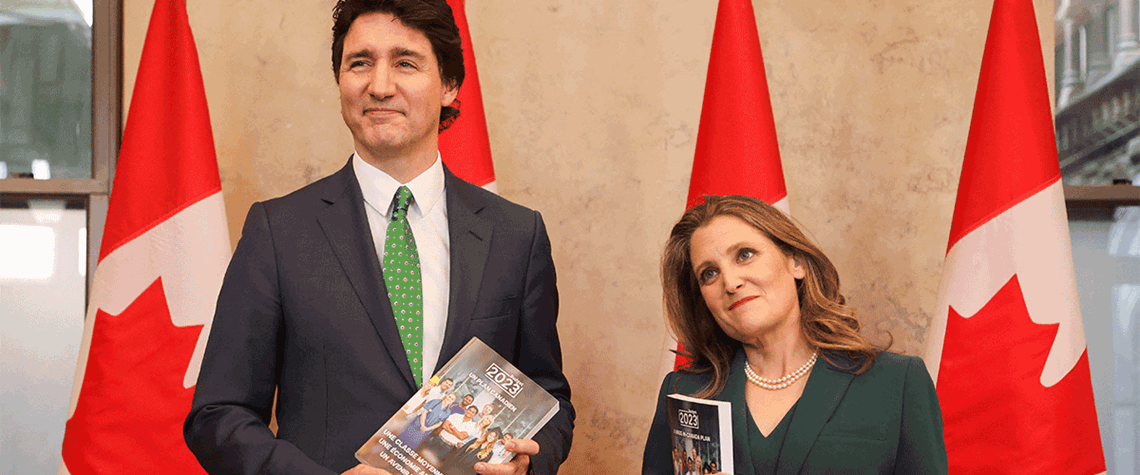

Canada unveils hydrogen investment tax credit

Projects seeking full rate must have carbon intensity below 4kg of CO₂/kg of hydrogen produced and meet labour requirements

Canada has included an investment tax credit for hydrogen production based on lifecycle carbon intensity in its 2023 federal budget. The maximum support covers 40pc of eligible project costs if carbon intensity is below 0.75kg of CO₂/kg of hydrogen produced, while the minimum covers 15pc of costs for projects with carbon intensity 2–4kg of CO₂/kg of hydrogen produced. Canada plans to calculate carbon intensity on a ‘cradle-to-gate’ basis, accounting for upstream emissions through to the point hydrogen exits the facility. As hydrogen is a zero-carbon gas, downstream emissions after production will not be considered, the government says. Projects converting low-carbon hydrogen to ammonia would

Also in this section

20 August 2025

Woodside Energy among backers of Australian firm’s Hydrilyte separation and storage technology

13 August 2025

If technology demand is a leading indicator, the industry’s recent downturn has further to go

12 August 2025

Norwegian renewables firm secures site for 400MW project, despite strategic shift away from green hydrogen

7 August 2025

Draft law opens door to large-scale carbon capture and storage, and could unleash investment in gas-based hydrogen projects