African LNG growth could come too late to cash in

Can new capacity come online soon enough to capitalise on elevated prices?

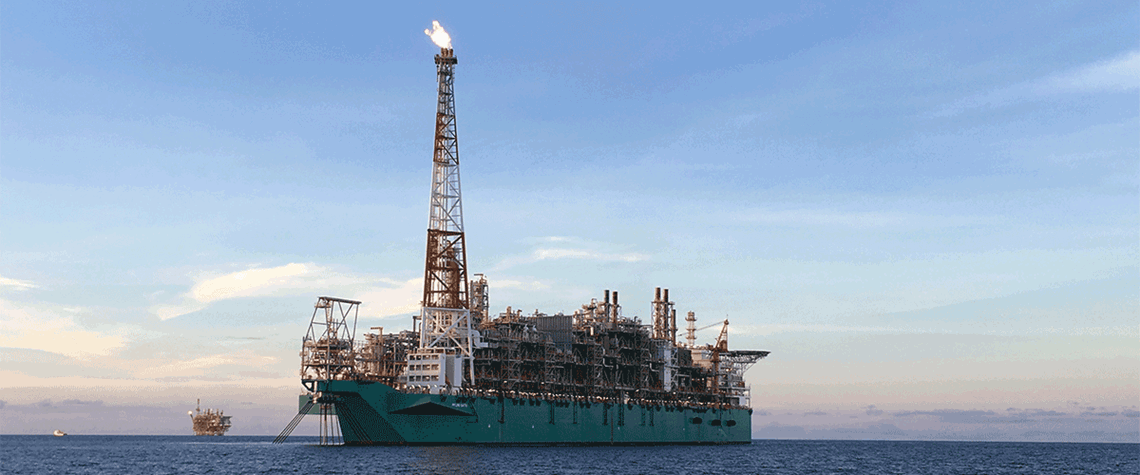

Global competition for limited LNG supplies and the resulting high prices continue to encourage development of new projects in Africa. The gas-rich continent, with vast potential for exports, has a number of important projects in the works at various stages of development—notably in Senegal, Mauritania, Mozambique, Nigeria, Congo-Brazzaville and Gabon. But uncertainty persists over how quickly the new capacity can be brought online and whether key projects can start production ahead of an expected global glut in LNG supply towards the end of this decade. The 2.3mn t/yr Greater Tortue Ahmeyim LNG project straddles the maritime boundary between Senegal and Mauritania and is the largest African

Also in this section

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true

25 February 2026

The surge in demand for fuel and petrochemical products in Asia has led to significant expansion in refining and petrochemicals capacities, with India and China leading the way