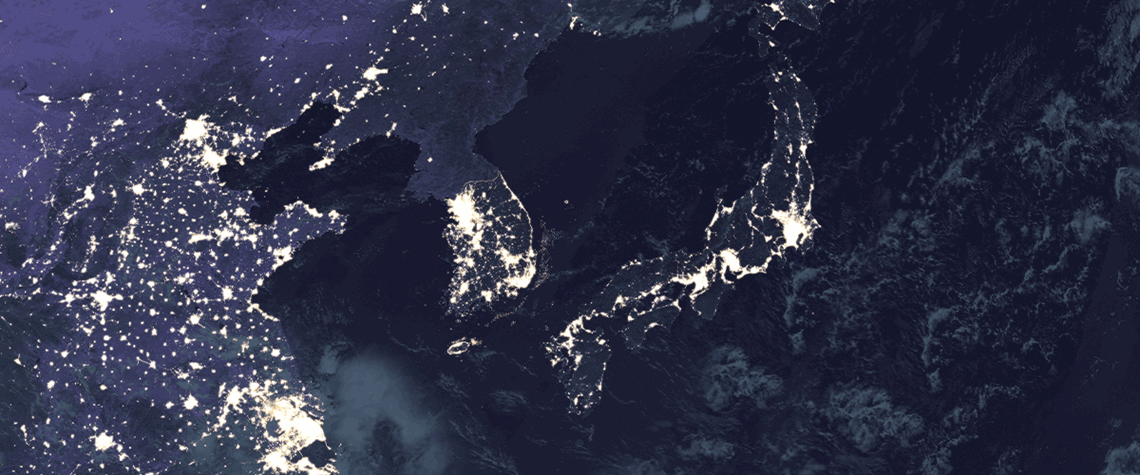

Muted winter LNG outlook for NE Asia

Seasonal temperatures will prove critical, but the LNG demand prospects for China, Japan and South Korea are currently soft

China is set to lead gas demand growth in Northeast Asia this winter amid signs the region’s biggest economy is bottoming out, although this is unlikely to mean a big jump in LNG imports as the country taps other sources of supply. And at the same time, more nuclear availability is expected to weigh on seasonal demand in Japan and South Korea. Recent green shoots in China’s economy suggest growth is stabilising, which may help domestic gas demand maintain momentum. China’s GDP beat predictions in Q3, with year-on-year growth of 4.9%, lifting growth for the first nine months of 2023 to 5.2%—ahead of Beijing’s official target of c.5%. Chinese gas demand has been strengthening since the spring,

Also in this section

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true