Outlook 2024: LNG investment - Hydrocarbon challenges or green opportunity?

Many LNG projects already incorporate emissions mitigation methods, hastening adoption for future projects

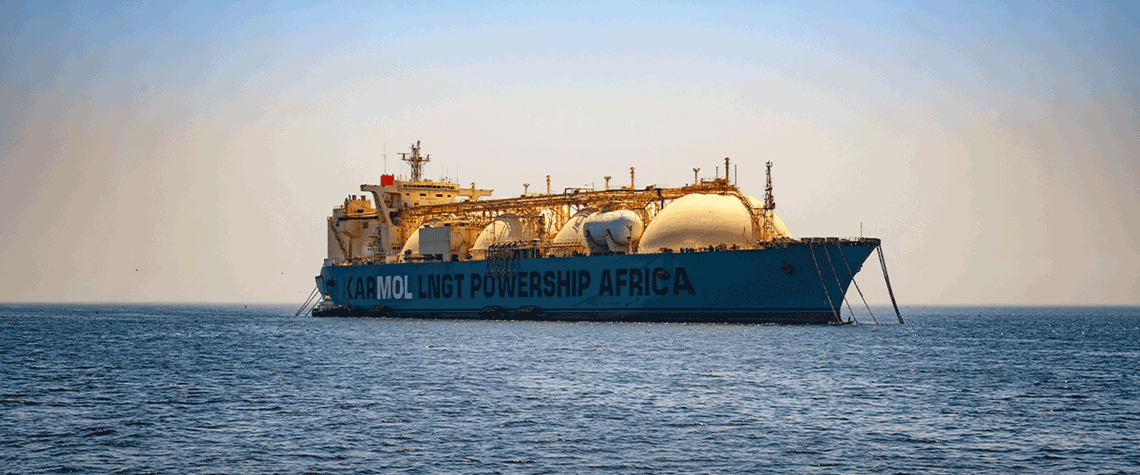

This decade’s unprecedented LNG supply investment is strongly focused on managing emissions intensity. Wide-ranging measures, particularly CCS, renewable-energy-powered liquefaction trains, carbon offsets and FLNG conversions, are being aggressively rolled out globally. While previous cycles of LNG production growth focused on the environmental benefits of offsetting buyers’ coal demand and shippers’ liquid fuel usage, supply projects are now under the greenhouse gas (GHG) microscope. Geopolitics and supply under-investment combined to push LNG spot prices to record highs in 2022 and c.$20/m Btu this winter. While LNG cargos will remain scarce until 2026, new trains, mainly in the US and Qat

Also in this section

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true

25 February 2026

The surge in demand for fuel and petrochemical products in Asia has led to significant expansion in refining and petrochemicals capacities, with India and China leading the way