Will new sanctions trigger a Russian recession?

With the economy already wobbling, further curtailment of investment in energy and other sectors would spell trouble

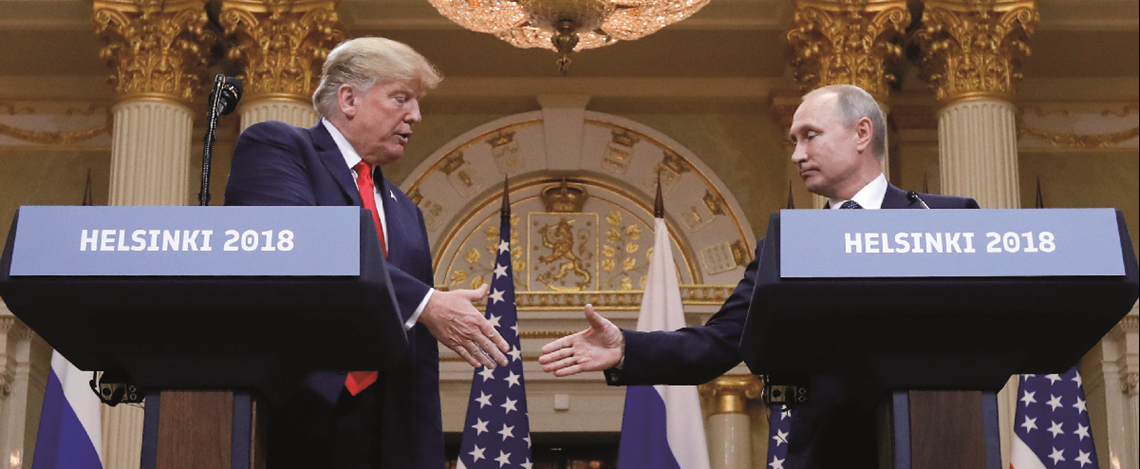

A further wave of US sanctions may spark a Russian recession, even though oil, income from which represents 40% of federal budget revenues, is trading at its highest level in more than four years. Russia has been able to weather sanctions imposed over the Kremlin's annexation of Crimea in 2014 largely because of the collapse in the rouble, which has greatly boosted export revenues. Oil producers have also mitigated the impact of sanctions by partly replacing Western sources of funding with domestic and Asian capital, as well as attempting to develop their own technology for shale, offshore and Artic deposits. However, new legislation from the US-dubbed the "sanctions bill from hell"-could se

Also in this section

25 July 2025

Mozambique’s insurgency continues, but the security situation near the LNG site has significantly improved, with TotalEnergies aiming to lift its force majeure within months

25 July 2025

There is a bifurcation in the global oil market as China’s stockpiling contrasts with reduced inventories elsewhere

24 July 2025

The reaction to proposed sanctions on Russian oil buyers has been muted, suggesting trader fatigue with Trump’s frequent bold and erratic threats

24 July 2025

Trump energy policies and changing consumer trends to upend oil supply and demand