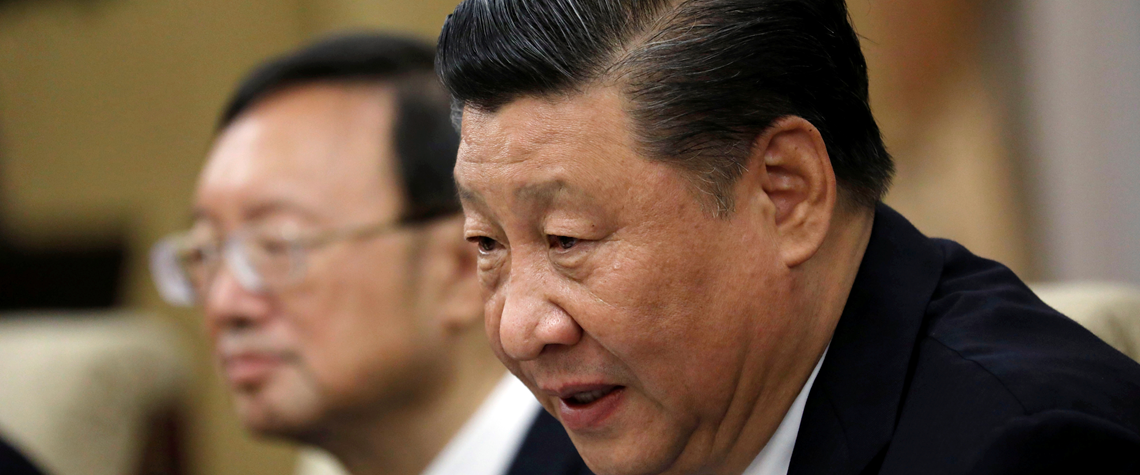

Cost could curb China’s gas appetite

The post-Tiananmen Square compact of rising living standards in return for political obedience may prioritise affordable residential energy over blue skies

An unpalatable truth it may be, but, in China, clean urban air and camera-friendly blue skies may be a ‘nice to have’. On the other hand, guaranteed affordable household energy, from any source, is core business. Thus, if the ruling Communist Party has to make a choice between cutting pollution and household bills rising to consumer-hurting levels, it is only going to jump one way. In addition, energy security is inextricably linked with China’s overall stability. Should gas import dependency reach levels that concern the authorities, it could further motivate a slowdown in the switch from coal to gas. Chinese gas demand growth rates of 15pc and 18pc in 2017 and 2018 were largely due to a fo

Also in this section

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true